Are you responsible for generating your own insurance leads?

Obviously this requires investing time and often money. Here we show you how to ensure a healthy return.

What is insurance lead generation?

Insurance lead generation is the act of insurance professionals deploying a variety of strategies and tactics in order to attract potential clients who are interested in their offerings.

Lead generation is critical in the insurance industry, as it ensures a healthy pipeline of potential customers and is key to have a thriving insurance business.

How to get insurance leads

Create a website chock full of value

As explained in The Ultimate Guide to Lead Generation, your website lies at the heart of your lead-generation strategy. Your goal is to convert visitors to leads. Create a clean site that is informative and easy to navigate featuring calls to action that make it easy for potential clients to quickly find what they need.

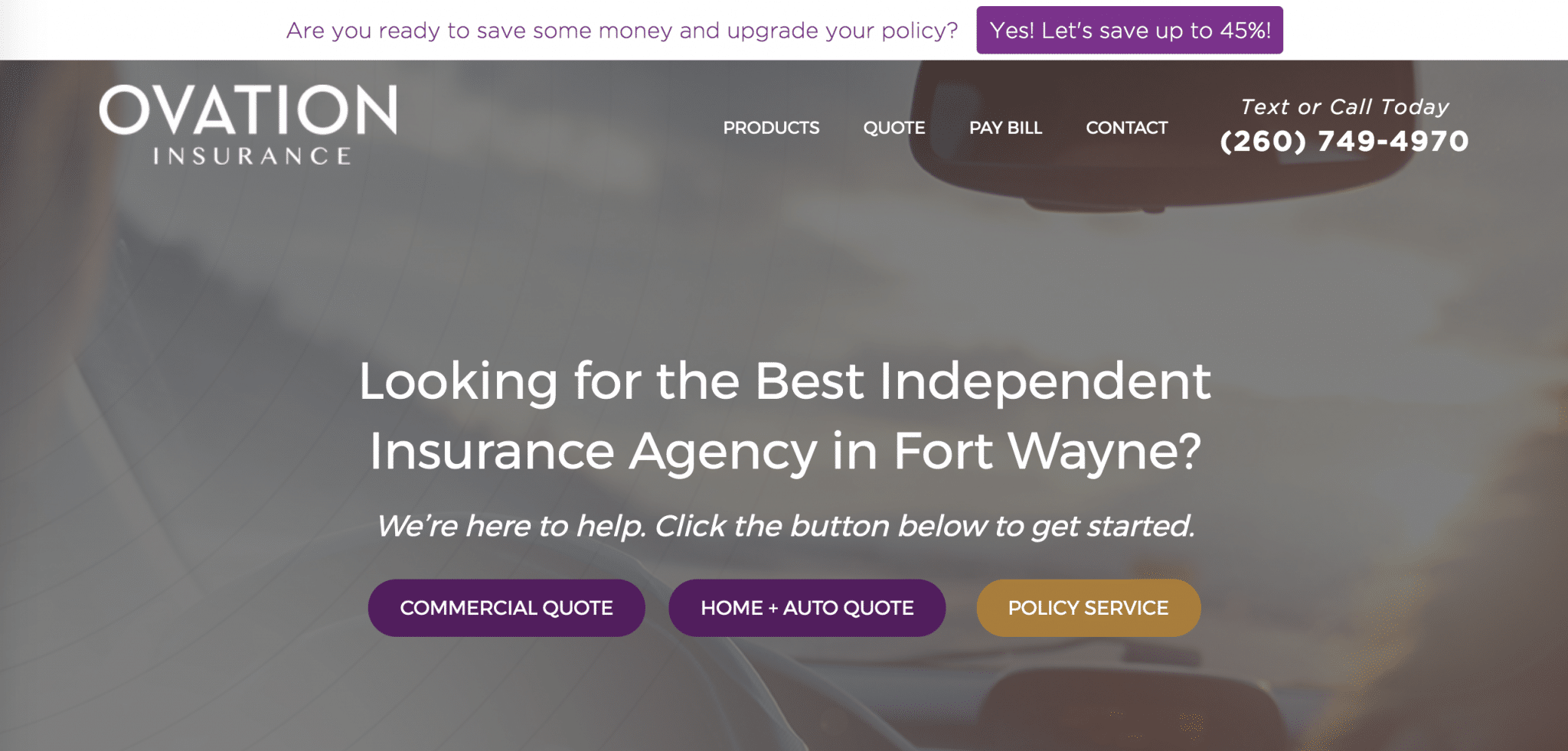

Atop this Ovation Insurance page are calls to action and contact mechanisms, including a special offer, mobile number to text or call, contact page and a trio of buttons that are impossible to miss.

Publish content

Buyers rely on the web to find insurance plans and products and they enter their questions into search engines. They’ll find you — and the advice you have to offer — only if you publish a steady stream of helpful content.

Optimize for search

Your site should feature a blog or articles that establish you as an industry expert. Learn how to apply the basics of search engine optimization (SEO) to your articles with keyword research and on-page optimization. This will increase your chances of ranking in search results and drive visitors to your website.

Offer lead magnets

Create content that requires interested prospects to complete a contact form so you can follow-up on the lead and build an email list. Agency Nation recommends offering lead magnets such as:

- Checklists

- Webinars

- Reports

- White papers

- Detailed guides

- Case studies

The Marketer's Guide to the Major Players in Native Advertising

Make videos

You don’t need to invest in cameras and studio equipment to make informative videos that attract buyers and win their trust. Your smart phone does the trick.

Tackle an important topic or answer a common question and post your videos on your website and social media pages. Or better yet, use Taboola to distribute your video through native video advertising. Show off your personality. The goal is to get people to connect with you on an emotional level.

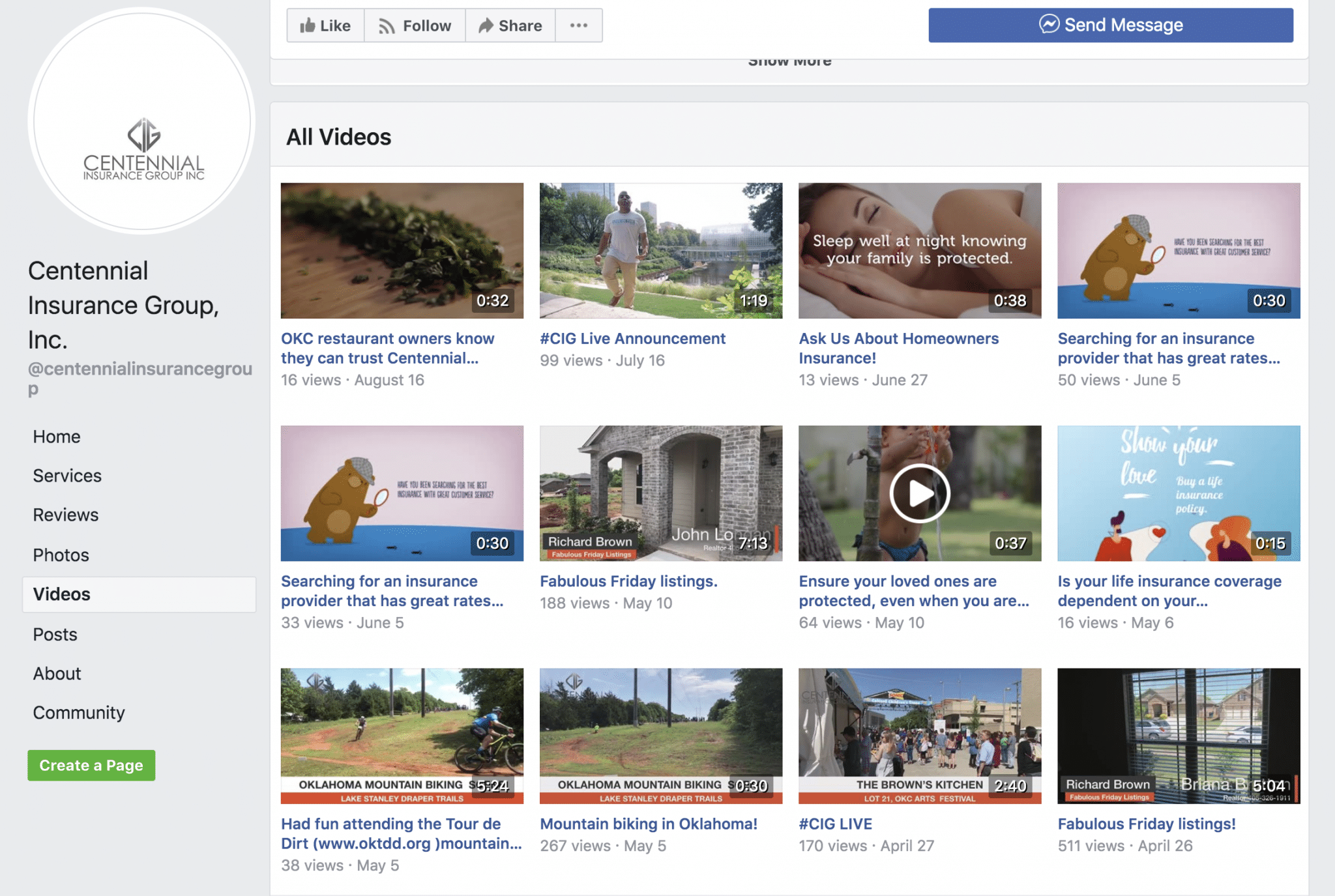

Richard Brown at Centennial Insurance swears by live video, which he shares via Facebook.

“One of the many benefits of doing Facebook Live videos, is that once I press the live button, I’m being my true, authentic self,” says Brown. “I’ve had the most success with my ‘Local Business Profile,’ where I go out and interview local business owners. It helps me learn more about the businesses in town and more about the people running them. On top of that, they’re sharing these videos on their personal pages as well as their business page, and of course, I’m sharing it as well. So it’s win-win for everyone involved.”

Offer interactive tools and content

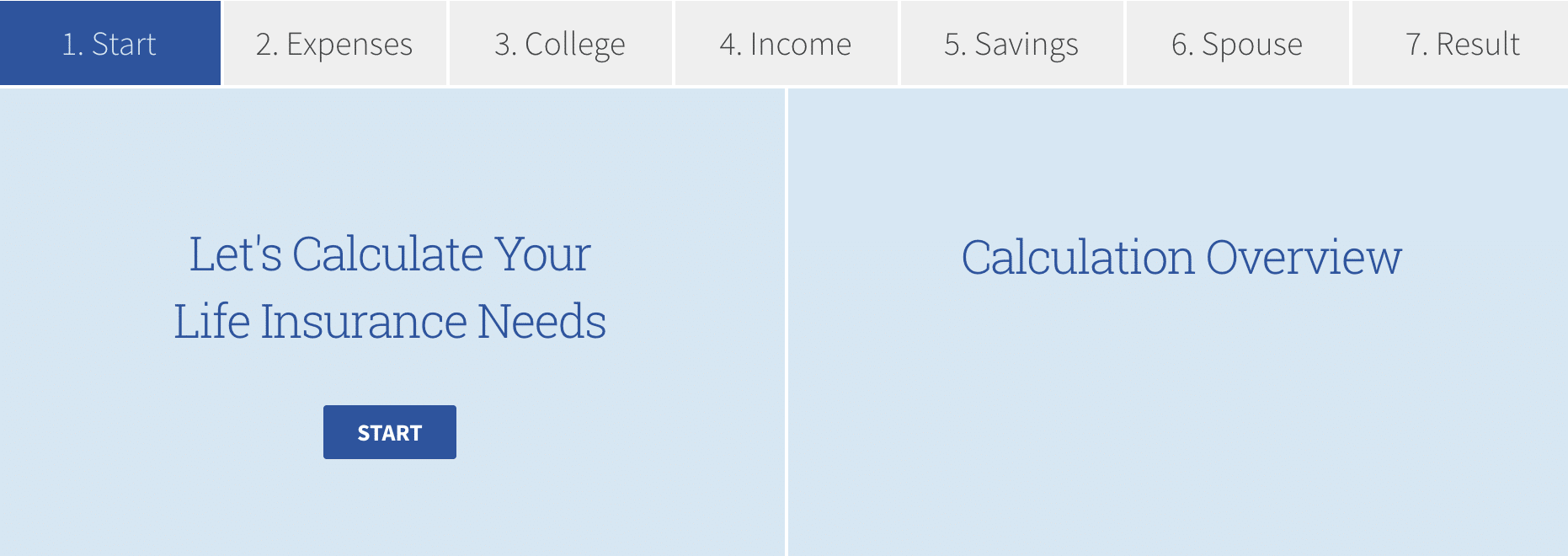

There are many ways to employ this strategy. Insurance agents can provide quick and easy tools : think quizzes, calculators, and quote generators.

This life insurance calculator offered at SimplyInsurance.com not only helps prospects help themselves, it also delivers useful information about your insurance sales leads.

Local directories

Claim listings for your agency on local directories such as Yelp, Facebook Places, Yahoo!, Bing Places, LinkedIn, and Whitepages.

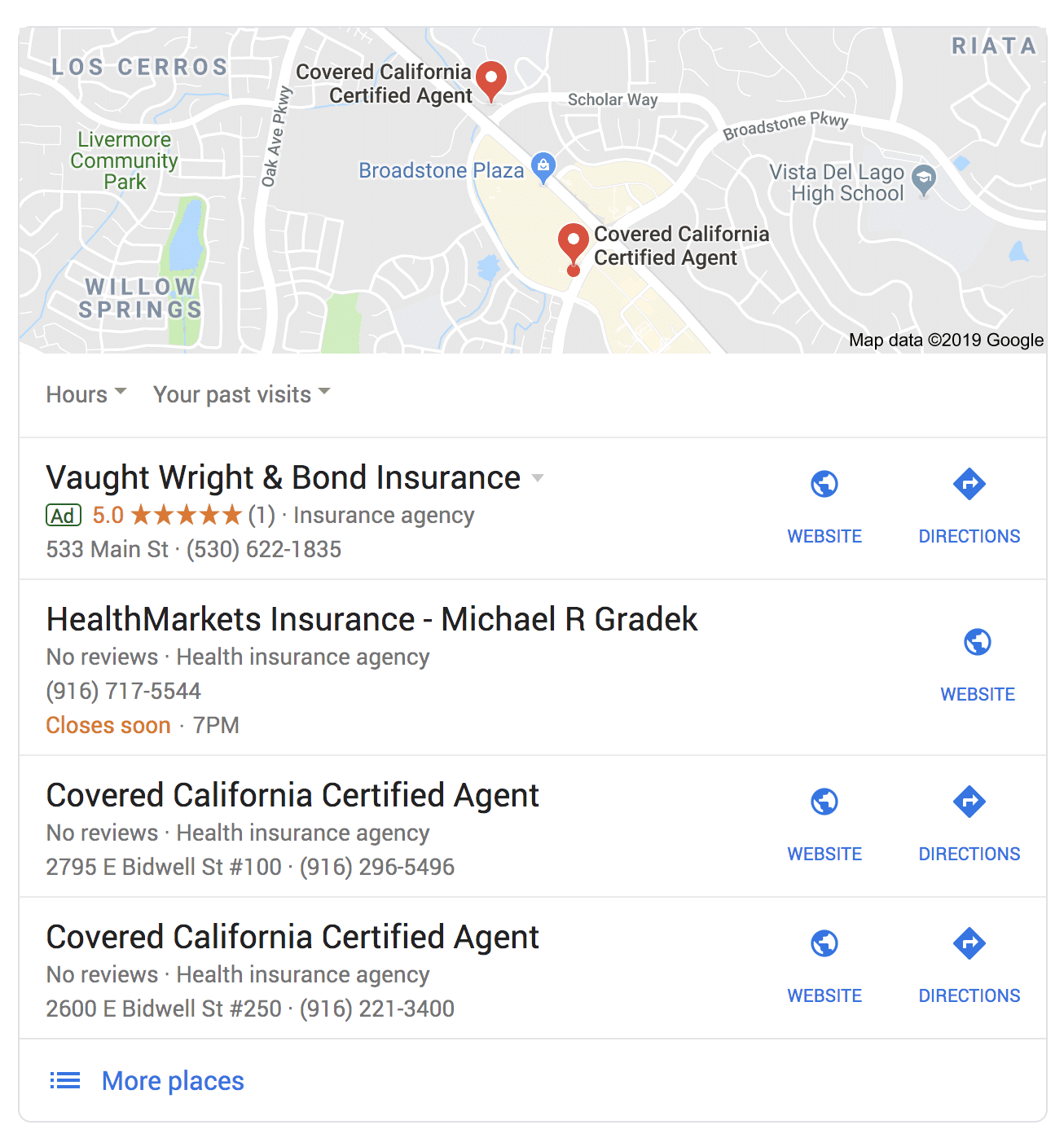

Most importantly, leverage the power of local SEO by claiming and optimizing a listing with Google My Business, a free directory of local businesses. It’s any easy process that enables your business to appear in local searches.

A search for “health insurance agents near me” produced the Google listing above, for example. Google My Business listings placed these agencies here .

Contribute to forums

Join insurance-related forums where people ask questions and become a knowledge resource. Position yourself as an industry professional delivering helpful answers.

Get customer reviews

Insurance is a perfect example of a service-based business that benefits from genuine customer reviews. The words of happy customers validate your business. Ask for reviews on your site and via a Yelp account. Display the ones you collect prominently.

Offer a chatbot

Make your website a 24/7 resource with chat functionality. Leadsurance recommends:

- Researching live chat or chatbot solutions to fit your needs.

- Configuring ‘triggers’ and ‘greetings’ to engage first-time visitors.

- Allocating staff to chat with interested site visitors.

- Helping your visitors with quotes and information they’ll value.

- Capturing names, emails, and/or phone numbers so an agent can follow-up.

Get active on social media

Make social media a part of your marketing efforts to increase your agency’s reach, build relationships, and possibly even generate new business. Here are some ways to achieve this:

- Target smart — Learn which social networks are most frequented by your clients and focus on them.

- Offer useful content — Make the content you share relevant to the customers you serve. Stay up-to-date on the issues affecting the industries you serve and create or curate content that addresses these topics.

- Be consistent — Your social efforts go further faster when you have a steady presence. A good guideline is to post daily on Facebook or Twitter and multiple times a week on LinkedIn.

- Think visual — Use rich media, including images and video, with your content to increase interest and interaction.

- Start conversations — Interact with followers and try to create dialogue. Respond to every comment or inquiry posted on your page.

- Stay on brand — Establish an image and voice for your company and continue to develop it according to your brand.

Here’s a great post on LinkedIn from Hyers and Associates aimed at addressing an important topic that prospects want to learn more about.

You can also try running social media ads – sponsored content – on any network you deem valuable. Social ad platforms enable you to hyper-target your reach with numerous criteria, control your spend as you wish, and analyze your results.

Conduct seminars

Your options here are many. You might host a basic informative seminar about insurance options for potential clients or sponsor events about a specific topic for a specific audience.

Promote referral programs

Referrals are a practical and easy way to generate new business. Ask satisfied clients for referrals.

Send postcards or emails to existing clients asking them to refer family and friends. Create an attractive offer that rewards your clients for referring your business, such as gift cards or tickets to an event.

Network

Networking is all-important to your business. Your city or town is likely to have networking groups where professionals from different industries meet regularly to socialize, swap strategies and refer business to each other. Find these groups and get involved. Be patient.

Matt Naimoli and Zach Gould at G&N Insurance have discovered the power of networking with professionals in their niche to build a steady stream of referrals.

“Zach and I were lucky to find our niche early on,” said Naimoli. “The home-buying experience was what we wanted to be experts in, so we started building referral networks around mortgage brokers, realtors, and attorneys.”

Buy leads

Some companies specialize in selling leads to insurance agents. You determine your location, specify your attributes, place an order, and receive a stack of leads. The good news – unlike getting leads from an employer – you’ll pay no commission. Exclusive leads are often available, but you’ll pay far more for them. The main drawback with third-party leads is the risk.

Is it risky? Yes. But it’s easy and instant, so you may want to try it a couple of times at first to see whether or not it pays dividends for your insurance business.

Knock on doors

In a video featured on AgencyNation.com, Troy Thompson of Pinnacle Insurance claims when he goes door-to-door for just one hour he quotes three policies and sells one. He offers four reasons why he swears by going door-to-door:

- There are no costs.

- You make personal connections.

- You can ‘self-underwrite’ – you can skip properties that offer visual warnings not to knock.

- The leads are hot.

We’ve covered lead generation for a number of professional services. Check out our advice for: