- News

- Business News

- India Business News

- Sentiments and business: What Air India acquisition means for Tatas

Trending

This story is from October 8, 2021

Sentiments and business: What Air India acquisition means for Tatas

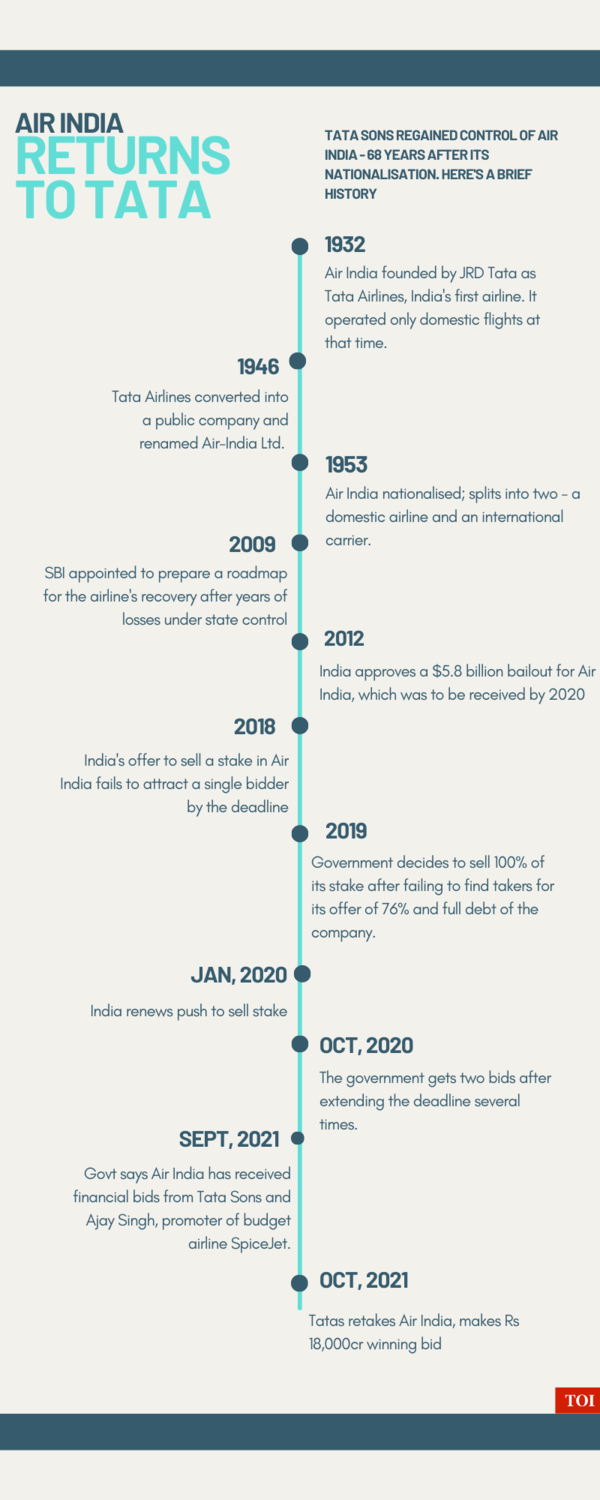

NEW DELHI: The Tata Group on Friday won the bid to acquire struggling national carrier Air India, an airline it founded almost 90 years ago.

The deal, which is expected to be finalised by the end of the year, puts Air India back in the hands of the group which founded it as Tata Airlines before it was nationalised in 1953.

The sentiment behind the marquee deal was hard to miss when the group's chairman emeritus Ratan Tata tweeted an emotional note with the caption "Welcome back, Air India."

The group already operates two airlines. One is Vistara, which is a joint venture with Singapore Airlines. The second is AirAsia India, in which it holds a majority stake.

With Air India acquisition, the Tata Group will become the second-largest domestic airline after Indigo, once the consolidation of the operations of all three airlines is completed.

The three airlines have a current combined market share of 26.9 per cent.

The announcement also brought cheer among several employee unions of Air India who were good forward to a final deal since a very long time.

Here's what Tatas will gain with the acquisition:

* Air India will give Tatas access to more than a hundred planes, thousands of trained pilots and crew, and lucrative landing and parking slots all around the world.

* The airline will give Tatas successful control of 4,400 domestic and 1,800 international landing and parking slots at domestic airports.

* It will also get 900 slots at airports overseas, the most lucrative of which are at London's Heathrow.

* It will acquire 100 per cent stake of the low-cost arm Air India Express and 50 per cent of AISATS, which provides cargo and ground handling services at major Indian airports.

* All exiting employees will be retained. Air India has 12,085 employees -- 8,084 permanent and 4,001 contractual. While, Air India Express has 1,434.

* The airline has the dubious distinction of having the highest number of employees on its rolls per aircraft - its 221 employees per aircraft compared with 127 per plane at Lufthansa, 140 at Singapore Airlines and British Airways 178 employees per aircraft.

The Tata Group quoted a winning financial bid of Rs 18,000 crore out of which Rs 15,300 crore in debt takeover and Rs 2,700 crore is cash.

The bid was higher than Rs 15,100-crore offer by a consortium led by SpiceJet promoter Ajay Singh and the reserve price of Rs 12,906 crore set by the government for the sale of its 100 per cent stake in the loss-making carrier.

However, the transaction does not include non-core assets like land and building, valued at Rs 14,718 crore, which are to be transferred to the government's special purpose vehicle (SPV) Air India Asset Holding Limited (AIAHL).

AIAHL will also hold Rs 46,262 crore remaining debt of the airline (Rs 61,562 crore total debt, of which Rs 15,300 crore will go to Tatas).

Over the last decade, more than Rs 1.10 lakh crore was infused by way of cash support and loan guarantees in the loss-making airline to keep it afloat.

The Tata group is a sprawling collection of nearly 100 companies that includes the country's largest automaker, the largest private steel company, and a leading outsourcing firm.

Tata bought Jaguar and Land Rover for $2.3 billion from Ford in June 2008.

(With inputs from agencies)

The deal, which is expected to be finalised by the end of the year, puts Air India back in the hands of the group which founded it as Tata Airlines before it was nationalised in 1953.

The sentiment behind the marquee deal was hard to miss when the group's chairman emeritus Ratan Tata tweeted an emotional note with the caption "Welcome back, Air India."

While there is indeed a visible sense of sentiment attached to the acquisition, the Tatas will also hope to use the deal to better its position in the aviation sector.

The group already operates two airlines. One is Vistara, which is a joint venture with Singapore Airlines. The second is AirAsia India, in which it holds a majority stake.

With Air India acquisition, the Tata Group will become the second-largest domestic airline after Indigo, once the consolidation of the operations of all three airlines is completed.

The three airlines have a current combined market share of 26.9 per cent.

The announcement also brought cheer among several employee unions of Air India who were good forward to a final deal since a very long time.

Here's what Tatas will gain with the acquisition:

* Air India will give Tatas access to more than a hundred planes, thousands of trained pilots and crew, and lucrative landing and parking slots all around the world.

* The airline will give Tatas successful control of 4,400 domestic and 1,800 international landing and parking slots at domestic airports.

* It will also get 900 slots at airports overseas, the most lucrative of which are at London's Heathrow.

* It will acquire 100 per cent stake of the low-cost arm Air India Express and 50 per cent of AISATS, which provides cargo and ground handling services at major Indian airports.

* All exiting employees will be retained. Air India has 12,085 employees -- 8,084 permanent and 4,001 contractual. While, Air India Express has 1,434.

* The airline has the dubious distinction of having the highest number of employees on its rolls per aircraft - its 221 employees per aircraft compared with 127 per plane at Lufthansa, 140 at Singapore Airlines and British Airways 178 employees per aircraft.

The winning bid

The Tata Group quoted a winning financial bid of Rs 18,000 crore out of which Rs 15,300 crore in debt takeover and Rs 2,700 crore is cash.

The bid was higher than Rs 15,100-crore offer by a consortium led by SpiceJet promoter Ajay Singh and the reserve price of Rs 12,906 crore set by the government for the sale of its 100 per cent stake in the loss-making carrier.

However, the transaction does not include non-core assets like land and building, valued at Rs 14,718 crore, which are to be transferred to the government's special purpose vehicle (SPV) Air India Asset Holding Limited (AIAHL).

AIAHL will also hold Rs 46,262 crore remaining debt of the airline (Rs 61,562 crore total debt, of which Rs 15,300 crore will go to Tatas).

Over the last decade, more than Rs 1.10 lakh crore was infused by way of cash support and loan guarantees in the loss-making airline to keep it afloat.

The Tata group is a sprawling collection of nearly 100 companies that includes the country's largest automaker, the largest private steel company, and a leading outsourcing firm.

Tata bought Jaguar and Land Rover for $2.3 billion from Ford in June 2008.

(With inputs from agencies)

End of Article

FOLLOW US ON SOCIAL MEDIA