Senior citizens often like to park their money in schemes offering assured returns with the least amount of risk possible when it comes to investment. Older people can choose multiple investment options, but fixed deposits (FDs) are their safe bet for assured returns. They help them earn returns without affecting their investment due to market fluctuations.

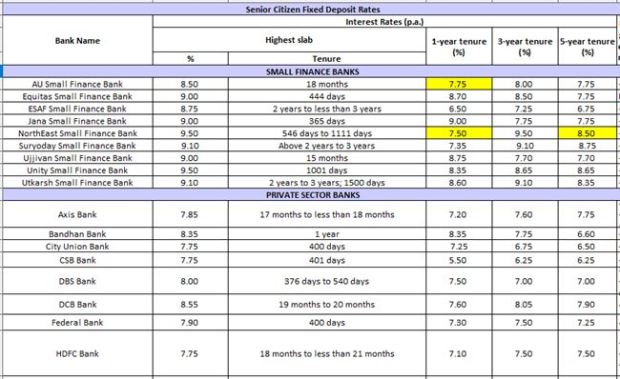

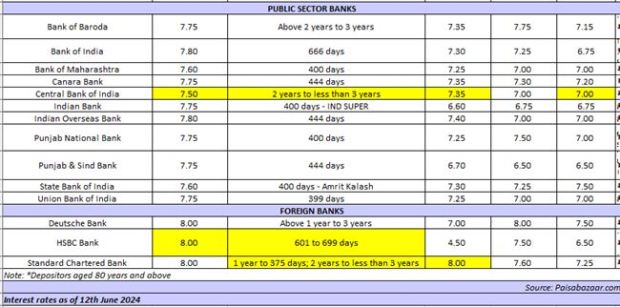

Senior citizens typically get higher interest rates on fixed deposits than regular citizens. Almost all banks offer senior citizens a 0.50 per cent higher interest rate. They also get tax exemption as the interest on deposits kept with banks, co-operative banks, or post offices is tax-exempt under Section 80TTB of the Income Tax Act. They can claim a deduction of up to Rs 50,000. Also, there will be no TDS deduction from the interest payments up to Rs 50,000 in a financial year.

If you are over 60 years, you can go for these FDs and choose the tenure and amount depending on your financial goals. Instead of putting your real money into one FD, you can open multiple FD accounts of different amounts and terms. It will help you reinvest your money at higher returns when the interest rate increases.

Also Read: Everything you must know about Floating Rate Home Loans

FDs are useful in case you need money for emergency use. Some banks allow you to break your FDs without levying any penalty or additional charges. However, choosing the tenure and interest rate after comparing the rates offered by different banks is advisable to make sure you get the best deal for your deposit. Also, you must read the terms and conditions before making your decisions.

It is effortless to open your FD account. You can visit any nearby bank branch or apply online as well.

Often it is advisable to open your FD account with the bank where you have an existing relationship as it becomes hassle-free for you. You also spend less time on documentation and other due diligence. However, you can easily choose any bank you want to park your money in a fixed deposit.

INTEREST ON TERM DEPOSITS FOR SENIOR CITIZENS