Spillover (economics): Difference between revisions

mNo edit summary |

mNo edit summary |

||

| Line 28: | Line 28: | ||

'''Externalities Spillover Effect''' |

'''Externalities Spillover Effect''' |

||

Externalities spillover effects are similar to general equilibrium effects in that they impact third parties which are not directly participating in the transaction. However, the key difference is that externalities are represented by social costs that are not reflected in a price change without government intervention<ref>{{cite web |url=https://pressbooks.bccampus.ca/uvicecon103/chapter/introduction-to-environmental-protection-and-negative-externalities/}}</ref>. An example of an externality may be pollution resulting from production of goods and services. This cost does not appear in the cost of production, rather it exists outside of the market supply and demand schedule. |

Externalities spillover effects are similar to general equilibrium effects in that they impact third parties which are not directly participating in the transaction. However, the key difference is that externalities are represented by social costs that are not reflected in a price change without government intervention<ref>{{cite web |last1=Hutchinson |first1=Emma |title=Principles of Microeconomics |url=https://pressbooks.bccampus.ca/uvicecon103/chapter/introduction-to-environmental-protection-and-negative-externalities/ |website=Pressbooks |publisher=University of Victoria |access-date=12 May 2022}}</ref>. An example of an externality may be pollution resulting from production of goods and services. This cost does not appear in the cost of production, rather it exists outside of the market supply and demand schedule. |

||

===Graphical representation=== |

===Graphical representation=== |

||

Externalities in the supply and demand curve: Note the graph representing a negative externality below. To illustrate this concept the ‘marginal social cost’ (MSC) is used in comparison to the ‘marginal private cost’ (MPC). Marginal social cost is the line which includes all externalities including the social cost of pollution in addition to regular production costs. Alternatively, marginal private cost also considers the regular production costs used in a transaction<ref>{{cite web |url=https://pressbooks.bccampus.ca/uvicecon103/chapter/introduction-to-environmental-protection-and-negative-externalities/}}</ref>. |

Externalities in the supply and demand curve: Note the graph representing a negative externality below. To illustrate this concept the ‘marginal social cost’ (MSC) is used in comparison to the ‘marginal private cost’ (MPC). Marginal social cost is the line which includes all externalities including the social cost of pollution in addition to regular production costs. Alternatively, marginal private cost also considers the regular production costs used in a transaction<ref>{{cite web |last1=Hutchinson |first1=Emma |title=Principles of Microeconomics |url=https://pressbooks.bccampus.ca/uvicecon103/chapter/introduction-to-environmental-protection-and-negative-externalities/ |website=Pressbooks |publisher=University of Victoria |access-date=12 May 2022}}</ref>. |

||

Thus, in the diagram below, if the market was functioning properly by accounting for negative externalities, society would produce at quantity 2 (Q2) and a higher price (P2). Without considering negative externalities,, society would produce at Quantity 1 (Q1) and at a lower price (P1). Hence, due to negative externalities (social costs) being excluded from transactions, society overproduces products with negative externalities and underprices them. |

Thus, in the diagram below, if the market was functioning properly by accounting for negative externalities, society would produce at quantity 2 (Q2) and a higher price (P2). Without considering negative externalities,, society would produce at Quantity 1 (Q1) and at a lower price (P1). Hence, due to negative externalities (social costs) being excluded from transactions, society overproduces products with negative externalities and underprices them. |

||

| Line 38: | Line 38: | ||

[[[[File:Negative Externalities.png|thumb|Negative Externalities in supply and demand schedule]]|thumb|Negative Externalities in Supply and Demand Schedule]] |

[[[[File:Negative Externalities.png|thumb|Negative Externalities in supply and demand schedule]]|thumb|Negative Externalities in Supply and Demand Schedule]] |

||

For positive externalities, see the diagram below. Note there are no social costs (negative externalities) that have been excluded from the private cost as there is a single cost line. In this case, social benefit (MSB) exceeds private benefit (MPB) |

For positive externalities, see the diagram below. Note there are no social costs (negative externalities) that have been excluded from the private cost as there is a single cost line. In this case, social benefit (MSB) exceeds private benefit (MPB)<ref>{{cite web |last1=Hutchinson |first1=Emma |title=Principles of Microeconomics |url=https://pressbooks.bccampus.ca/uvicecon103/chapter/introduction-to-environmental-protection-and-negative-externalities/ |website=Pressbooks |publisher=University of Victoria |access-date=12 May 2022}}</ref>. In effect, this means the private benefit of a transaction (ie, profit for a newly established business) is only part of the benefit accrued as an additional social cost (ie, Surrounding cafes and restaurants gain more customers as employees from the newly established business buy lunch). Hence if the market was functioning properly to include social benefits, the market would produce at quantity 2 (Q2) and at price 2 (P2) which represents the true equilibrium quantity and prices. |

||

[[File:Positive Externalities.png|thumb|Positive Externalities in Supply and Demand Schedule]] |

[[File:Positive Externalities.png|thumb|Positive Externalities in Supply and Demand Schedule]] |

||

| Line 53: | Line 53: | ||

Globalisation has been a prominent influence on the economic spillover effect in the global economy. Due to rising economic interactions including trade and investment between economies, the likelihood has risen that events impact one economy will in turn impact others who have economic ties and dependencies. There are opposing views on the aggregate impact of globalisation as having either positive or negative spillover effects for the global economy. For instance, studies by Applied Economics journal<ref>{{cite web |url=https://doi.org/10.1080/00036840500392078}}</ref> indicates that globalisation has been impactful in promoting economic growth across nations in part due to the spillover. However studies by <ref>{{cite web |url=https://doi.org/10.1016/j.eneco.2018.05.016}}</ref> find that despite there being evidence that there is a positive correlation between trade openness and carbon dioxide emissions (negative externality), there could also exist benefits from globalisation impacting the environment through factors including spread of technology and knowledge beyond borders. |

Globalisation has been a prominent influence on the economic spillover effect in the global economy. Due to rising economic interactions including trade and investment between economies, the likelihood has risen that events impact one economy will in turn impact others who have economic ties and dependencies. There are opposing views on the aggregate impact of globalisation as having either positive or negative spillover effects for the global economy. For instance, studies by Applied Economics journal<ref>{{cite web |url=https://doi.org/10.1080/00036840500392078}}</ref> indicates that globalisation has been impactful in promoting economic growth across nations in part due to the spillover. However studies by <ref>{{cite web |url=https://doi.org/10.1016/j.eneco.2018.05.016}}</ref> find that despite there being evidence that there is a positive correlation between trade openness and carbon dioxide emissions (negative externality), there could also exist benefits from globalisation impacting the environment through factors including spread of technology and knowledge beyond borders. |

||

==See also== |

==See also== |

||

Revision as of 01:21, 12 May 2022

This article needs additional citations for verification. (May 2017) |

In economics a spillover is an economic event in one context that occurs because of something else in a seemingly unrelated context. For example, externalities of economic activity are non-monetary spillover effects upon non-participants. Odors from a rendering plant are negative spillover effects upon its neighbors; the beauty of a homeowner's flower garden is a positive spillover effect upon neighbors.

In the same way, the economic benefits of increased trade are the spillover effects anticipated in the formation of multilateral alliances of many of the regional nation states: e.g. SAARC (South Asian Association for Regional Cooperation), ASEAN (Association of South East Asian Nations).

In an economy in which some markets fail to clear, such failure can influence the demand or supply behavior of affected participants in other markets, causing their effective demand or effective supply to differ from their notional (unconstrained) demand or supply.

Another kind of spillover is generated by information. For example, when more information about someone generates more information about people related to her, and that information helps to eliminate asymmetries in information, then the spillover effects are positive (this issue has been found constantly in the economics and finance literature, see for instance the case of local banking markets[1]).

History of the Concept

19th century economists John Stuart Mill and Henry Sidgwick are credited with founding the early concepts related to spillover effects. These ideas extend upon Adam Smith's famous ‘Invisible Hand’ theory which is a price that suggests prices can be naturally determined by the forces of supply and demand to form a market price and market quantity where buyers and sellers are willing to make a transaction. Spillover effects, also known as externalities in market theory are the costs associated with a transaction borne upon a party/parties that are non participants in the transaction (ie, Production costs do not consider the cost of pollution on society at large). Furthermore, Mill argues that Government intervention in the market can be a useful tool when necessary to prevent or mitigate spillover effects when necessary[2] as opposed to Adam Smith who believed a competitive market with little to no intervention provides the most adequate outcome.

Types of Spillover effects

There are different types of spillover effects which can take place. According to the Corporate Finance Institute [3], spillover effects can be categorised in the following ways: 1. Social Interaction Spillover Effect 2. General Equilibrium Effect 3. Externalities Spillover Effect

Social Interaction Spillover Effect

Social interaction spillover effect occurs when community programs and initiatives have the effect of benefiting the welfare of people and in turn the community at large. For example, free education, social welfare payments and other public goods are designed to improve the social behaviour, education and employability of citizens which in turn could lower crime rates and poverty in the community in theory[4].

General Equilibrium Effects

General equilibrium effects can happen when there is an impact in the market either positively or negatively creating a spillover effect through interdependence of firms and households in the economy. This occurs as entities do not operate in a bubble, hence when there is a financial shock or boon to a business or industry, this impacts factors including pricing, costs and wages for other entities. Rather, entities experience shocks or boons in relation to other entities[5]. For example, if there were to be a global shortage of oil production, global supply and demand would interact to put upward pressure on oil and in turn fuel prices. This occurs as consumers are effectively bidding for the remaining oil which is more scarce than before, forming a new equilibrium price in the market. Hence fuel stations and consumers are impacted by the spillover effect of oil shortages.

Externalities Spillover Effect

Externalities spillover effects are similar to general equilibrium effects in that they impact third parties which are not directly participating in the transaction. However, the key difference is that externalities are represented by social costs that are not reflected in a price change without government intervention[6]. An example of an externality may be pollution resulting from production of goods and services. This cost does not appear in the cost of production, rather it exists outside of the market supply and demand schedule.

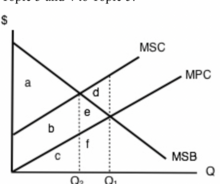

Graphical representation

Externalities in the supply and demand curve: Note the graph representing a negative externality below. To illustrate this concept the ‘marginal social cost’ (MSC) is used in comparison to the ‘marginal private cost’ (MPC). Marginal social cost is the line which includes all externalities including the social cost of pollution in addition to regular production costs. Alternatively, marginal private cost also considers the regular production costs used in a transaction[7].

Thus, in the diagram below, if the market was functioning properly by accounting for negative externalities, society would produce at quantity 2 (Q2) and a higher price (P2). Without considering negative externalities,, society would produce at Quantity 1 (Q1) and at a lower price (P1). Hence, due to negative externalities (social costs) being excluded from transactions, society overproduces products with negative externalities and underprices them.

[[

|thumb|Negative Externalities in Supply and Demand Schedule]]

For positive externalities, see the diagram below. Note there are no social costs (negative externalities) that have been excluded from the private cost as there is a single cost line. In this case, social benefit (MSB) exceeds private benefit (MPB)[8]. In effect, this means the private benefit of a transaction (ie, profit for a newly established business) is only part of the benefit accrued as an additional social cost (ie, Surrounding cafes and restaurants gain more customers as employees from the newly established business buy lunch). Hence if the market was functioning properly to include social benefits, the market would produce at quantity 2 (Q2) and at price 2 (P2) which represents the true equilibrium quantity and prices.

Examples of spillover effects

The COVID-19 Pandemic

A high profile example of spillover effects is the COVID-19 pandemic. The global economy has become more interdependent in the 21st century as globalisation has enhanced countries' reliance on other parts of the world for economic growth. Therefore, when the emergence of the pandemic forced countries to close their borders, this had a spillover effect, creating an economic shortfall. Studies from BIS Quarterly [9] on spillover effects in the pandemic showed that confinement measures implemented by countries to limit the number of people contracting the virus showed there is no immunity from economic spillover and spillback effects between regions. The paper notes this is true even for regions that have domestic policy measures in place to reduce the impact of economic slowdown and are not economically immune from other countries without effective measures.

Influences on spillover effects

Globalisation

Globalisation has been a prominent influence on the economic spillover effect in the global economy. Due to rising economic interactions including trade and investment between economies, the likelihood has risen that events impact one economy will in turn impact others who have economic ties and dependencies. There are opposing views on the aggregate impact of globalisation as having either positive or negative spillover effects for the global economy. For instance, studies by Applied Economics journal[10] indicates that globalisation has been impactful in promoting economic growth across nations in part due to the spillover. However studies by [11] find that despite there being evidence that there is a positive correlation between trade openness and carbon dioxide emissions (negative externality), there could also exist benefits from globalisation impacting the environment through factors including spread of technology and knowledge beyond borders.

See also

- Carbon leakage, in climate policy

- Indirect land use change impacts of biofuels, in climate policy

- Knowledge spillover

References

- ^ Garmaise, M. & G. Natividad (2016). "Spillovers in Local Banking Markets". The Review of Corporate Finance Studies. 5 (2): 139–165. doi:10.1093/rcfs/cfw005.

- ^ Medema, Steven G. (1 September 2007). "The Hesitant Hand: Mill, Sidgwick, and the Evolution of the Theory of Market Failure". History of Political Economy. 39 (3): 331–358. doi:10.1215/00182702-2007-014.

- ^ "Spillover Effects". Corporate Finance Institue. Retrieved 12 May 2022.

- ^ "Spillover Effects". Corporate Finance Institue. Retrieved 12 May 2022.

- ^ Huber, Kilian. "Estimating General Equilibrium Spillovers of Large-Scale Shocks". Brecker Friedman Institute. Brecker Friedman Institute. Retrieved 12 May 2022.

- ^ Hutchinson, Emma. "Principles of Microeconomics". Pressbooks. University of Victoria. Retrieved 12 May 2022.

- ^ Hutchinson, Emma. "Principles of Microeconomics". Pressbooks. University of Victoria. Retrieved 12 May 2022.

- ^ Hutchinson, Emma. "Principles of Microeconomics". Pressbooks. University of Victoria. Retrieved 12 May 2022.

- ^ https://www.bis.org/publ/bisbull04.htm.

{{cite web}}: Missing or empty|title=(help) - ^ https://doi.org/10.1080/00036840500392078.

{{cite web}}: Missing or empty|title=(help) - ^ https://doi.org/10.1016/j.eneco.2018.05.016.

{{cite web}}: Missing or empty|title=(help)