Poll taxes in the United States

Poll taxes were used in the United States until they were outlawed following the Voting Rights Act of 1965. Poll taxes (taxes of a fixed amount on every liable individual, regardless of their income) had also been a major source of government funding among the colonies and states which went on to form the United States. Poll taxes became a tool of disenfranchisement in the South during Jim Crow, following the end of Reconstruction. This form of disenfranchisement was common until the Voting Rights Act, which is considered one of the most monumental pieces of civil rights legislation ever passed. The Voting Rights Act followed the Twenty-fourth Amendment to the United States Constitution, which prohibited both Congress and the states from implementing poll taxes, but only for federal elections.

Description

[edit]A poll tax is a tax of a fixed sum on every liable individual (typically every adult), without reference to income or resources. Various privileges of citizenship, including voter registration or issuance of driving licenses and resident hunting and fishing licenses, were conditioned on payment of poll taxes to encourage the collection of this tax revenue. In places that instituted a cumulative poll tax, missed poll taxes from prior years must also be paid to receive the restricted privileges.[1][2][3]

History

[edit]Although often associated with states of the former Confederate States of America, poll taxes were also in place in some northern and western states, including California, Connecticut, Maine, Massachusetts, Minnesota, New Hampshire, Ohio, Pennsylvania, Vermont, Rhode Island, and Wisconsin.[4] Poll taxes had been a major source of government funding among the colonies which formed the United States. For instance, poll taxes made up from one-third to one-half of the tax revenue of colonial Massachusetts.

Property taxes assumed a larger share of tax revenues as land values rose when population increases encouraged settlement of the American West.[5] Some western states found no need for poll tax requirements; but poll taxes and payment incentives remained in eastern states.

Voter registration

[edit]Poll taxes became a tool of disenfranchisement in the South during Jim Crow, following the end of Reconstruction. Payment of a poll tax was a prerequisite to the registration for voting in a number of states until 1965. The tax emerged in some states of the United States in the late nineteenth century as part of the Jim Crow laws. After the right to vote was extended to all races by the enactment of the Fifteenth Amendment to the United States Constitution, a number of states enacted poll tax laws as a device for restricting voting rights. The laws often included a grandfather clause, which allowed any adult male whose father or grandfather had voted in a specific year prior to the abolition of slavery to vote without paying the tax.[6] These laws, along with unfairly implemented literacy tests and extra-legal intimidation,[7] such as by the Ku Klux Klan, achieved the desired effect of disenfranchising Asian-American, Native American voters and poor whites as well, but in particular the poll tax was disproportionately directed at African-American voters.

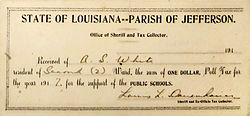

Proof of payment of a poll tax was a prerequisite to voter registration in Florida, Alabama, Tennessee, Arkansas, Louisiana, Mississippi, Georgia (1877), North and South Carolina, Virginia (until 1882 and again from 1902 with its new constitution),[8][9] and Texas (1902).[10] The Texas poll tax, instituted on people who were eligible to vote in all other respects, was between $1.50 and $1.75 ($62.00 in 2023). This was "a lot of money at the time, and a big barrier to the working classes and poor."[10] Georgia created a cumulative poll tax requirement in 1877: men of any race 21 to 60 years of age had to pay a sum of money for every year from the time they had turned 21, or from the time that the law took effect.[11]

The poll tax requirements applied to whites as well as blacks, and also adversely affected poor citizens. The laws that allowed the poll tax did not specify a certain group of people.[12] This meant that anyone, including white women, could also be discriminated against when they went to vote. One example is in Alabama where white women were discriminated against and then organized to secure their right to vote. One group of women that did this was the Women's Joint Legislative Council of Alabama (WJLC).[12] African American women also organized in groups against being denied voting rights. In 1942, an African American woman named Lottie Polk Gaffney, along with four other women, unsuccessfully sued the South Carolina Cherokee County Registration Board with the help of the NAACP.[13] Gaffney sued for her right to vote after having been stopped from registering to vote two years earlier. As a result of her suing the county the mailman did not deliver her mail for quite some time.[14]

Many states required payment of the tax at a time separate from the election, and then required voters to bring receipts with them to the polls. If they could not locate such receipts, they could not vote. In addition, many states surrounded registration and voting with complex record-keeping requirements.[15] These were particularly difficult for sharecropper and tenant farmers to comply with, as they moved frequently.

The poll tax was sometimes used alone or together with a literacy qualification. In a kind of grandfather clause, North Carolina in 1900 exempted from the poll tax those men entitled to vote as of January 1, 1867. This excluded all blacks, who did not then have suffrage.[16]

Judicial challenge

[edit]In 1937, in Breedlove v. Suttles, 302 U.S. 277 (1937), the United States Supreme Court found that a prerequisite that poll taxes be paid for registration to vote was constitutional. The case involved the Georgia poll tax of $1 (equivalent to $21 in 2023). Georgia abolished its poll tax in 1945.[17] Florida repealed its poll tax in 1937.[18]: 346

The 24th Amendment, ratified in 1964, abolished the use of the poll tax (or any other tax) as a pre-condition for voting in federal elections,[19] but made no mention of poll taxes in state elections. The Voting Rights Act of 1965 made clarifying remarks which helped to outlaw the practice nationwide, as well as make it enforceable by law.

In the 1966 case of Harper v. Virginia State Board of Elections, the Supreme Court reversed its decision in Breedlove v. Suttles to also include the imposition of poll taxes in state elections as violating the Equal Protection Clause of the 14th Amendment to the United States Constitution.

The Harper ruling was one of several that relied on the Equal Protection clause of the 14th Amendment rather than the more direct provision of the 24th Amendment. In a two-month period in the spring of 1966, Federal courts declared unconstitutional poll tax laws in the last four states that still had them, starting with Texas on February 9. Decisions followed for Alabama (March 3) and Virginia (March 25). Mississippi's $2.00 poll tax (equivalent to $19 in 2023) was the last to fall, declared unconstitutional on April 8, 1966, by a federal panel.[20] Virginia attempted to partially abolish its poll tax by requiring a residence certification, but the Supreme Court rejected the arrangement in 1965 in Harman v. Forssenius.

Poll taxes by state

[edit]| State | Cost | Implementation | Repeal |

|---|---|---|---|

| Alabama | $1.50 ($55.00 in 2023) | 1901[21]: 471 | 1966[22] |

| Arkansas | $1.00 ($33.91 in 2023) | 1891[21]: 471 [Notes 1] | 1964[24] |

| California | $2.00 ($73.00 in 2023) | 1850[25] | 1914 |

| Connecticut | ? | 1649 | 1947 |

| Delaware | ? | 1897[21]: 471 | |

| Florida | $1.00[26] ($33.91 in 2023) | 1885[21]: 471 [Notes 2] | 1937[27] |

| Georgia | $1.00 ($28.61 in 2023) | 1877[28][Notes 3] | 1945[12] |

| Louisiana | $1.00[30] ($36.62 in 2023) | 1898[21]: 471 | 1934[31] |

| Maine | $3.00 ($98.00 in 2023) | 1845 | 1973[32] |

| Maryland | ? | 1896[21]: 471 | |

| Massachusetts | $3.00[33] ($60.00 in 2023) | 1865[21]: 470 | 1890[21]: 470 |

| Minnesota | $1.00 ($24.75 in 2023) | 1863 | ? |

| Mississippi | $2.00 ($68.00 in 2023) | 1890[21]: 471 | 1966[34] |

| New Hampshire | ? | ? | ? |

| North Carolina | ? | 1900[21]: 471 | 1920[12] |

| Ohio* | ? | ? | ? |

| Oklahoma | $2.00 ($65.00 in 2023) | 1907 | 1986[35] |

| Pennsylvania | ? | 1865[21]: 470 | 1933[36] |

| Rhode Island | $1.00 | 1865[21]: 470 | ? |

| South Carolina | $1.00 ($36.62 in 2023) | 1895[21]: 471 | 1951[37] |

| Tennessee | $1.00 ($24.09 in 2023) | 1870[21]: 471 [Notes 4] | 1953[12] |

| Texas | $1.50 ($53.00 in 2023) to 1.75[39] ($62.00 in 2023) | 1902[21]: 471 | 1966[39] |

| Vermont | $1.00[40] ($16.33 in 2023) | 1778 | 1982 |

| Virginia | $65.00 in 2021 | 1902[21]: 471 ($53.00 in 2023) | 1966[41][42] |

| Wisconsin | ? | ? | ? |

See also

[edit]References

[edit]Informational notes

- ^ Legislation was passed by the House of the Assembly in 1891 and confirmed by voter referendum in 1892.[23]: 246

- ^ Though poll tax legislation was approved in 1885, charging the tax as a condition of voting did not occur until 1889.[21]: 471

- ^ While the Constitution of 1877 allowed collection of poll taxes to fund schools,[29] the requirement to pay as a prerequisite to voting was not authorized until 1908.[28]

- ^ The State Constitution established a poll tax in 1870, but it remained unimplemented until 1890 when the legislature activated it.[21]: 471 [38]

Citations

- ^ Erb, Kelly Phillips. "For Election Day, A History Of The Poll Tax In America". Forbes. Retrieved August 10, 2024.

- ^ "How Jim Crow‑Era Laws Suppressed the African American Vote for Generations". HISTORY. August 8, 2023. Retrieved August 10, 2024.

- ^ "Interpretation: The Twenty-Fourth Amendment | Constitution Center". National Constitution Center – constitutioncenter.org. Retrieved August 10, 2024.

- ^ State of Maine Special Tax Commission (1890). Report of the Special Tax Commission of Maine. Maine: Burleigh & Flynt. pp. 39–41. OCLC 551368287.

- ^ Bullock, Charles J. (1916). "The Taxation of Property and Income in Massachusetts". The Quarterly Journal of Economics. 31 (1): 1–61. doi:10.2307/1885988. JSTOR 1885988.

- ^ Greenblatt, Alan (October 22, 2013). "The Racial History Of The 'Grandfather Clause'". Code Switch. NPR. Retrieved June 8, 2020.

- ^ "Civil Rights Movement – Voting Rights: Are You "Qualified" to Vote? Take a "Literacy Test" to Find Out". crmvet.org. Retrieved September 21, 2019.

- ^ "Virginia's Constitutional Convention of 1901–1902". Virginia Historical Society. Archived from the original on October 2, 2006. Retrieved September 14, 2006.

- ^ Dabney, Virginius (1971). Virginia, The New Dominion. University Press of Virginia. pp. 436–437. ISBN 978-0-8139-1015-4.

- ^ a b "Historical Barriers to Voting". Texas Politics. University of Texas. Archived from the original on April 2, 2008. Retrieved November 4, 2012.

- ^ "Atlanta in the Civil Rights Movement". Atlanta Regional Council for Higher Education. Archived from the original on June 22, 2004.

- ^ a b c d e Wilkerson-Freeman, Sarah (2002). "The Second Battle for Woman Suffrage: Alabama White Women, the Poll Tax, and V. O. Key's Master Narrative of Southern Politics". The Journal of Southern History. 68 (2): 333–374. doi:10.2307/3069935. JSTOR 3069935.

- ^ Cherisse Jones-Branch. ""To Speak When and Where I Can": African American Women's Political Activism in South Carolina in the 1940s and 1950s". The South Carolina Historical Magazine. Vol. 107, No. 3 (Jul., 2006), pp. 204–205 https://www.jstor.org/stable/27570823

- ^ Jones-Branch, Cherisse (July 2006). "'To Speak When and Where I Can': African American Women's Political Activism in South Carolina in the 1940s and 1950s". The South Carolina Historical Magazine. 107 (3): 206. JSTOR 27570823.

- ^ Andrews, E. Benjamin (1912). History of the United States. New York: Charles Scribner's Sons. p. 28. ISBN 9781449977320.

- ^ Pildes, Richard H. (2000). "Democracy, Anti-Democracy, and the Canon". Constitutional Commentary. 17. doi:10.2139/ssrn.224731. hdl:11299/168068. SSRN 224731.

- ^ Novotny, Patrick (2007). This Georgia Rising: Education, Civil Rights, and the Politics of Change in Georgia in The 1940s. Mercer University Press. pp. 150–. ISBN 9780881460889. Retrieved January 6, 2013.

- ^ Mohl, Raymond A. (1995). "Race Relations in Miami since the 1920s". In Colburn, David R.; Landers, Jane L. (eds.). The African American Heritage of Florida. University Press of Florida. pp. 326–365. ISBN 978-0813013329.

- ^ Jillson, Cal (February 22, 2011). Texas Politics: Governing the Lone Star State. Taylor & Francis. pp. 38–. ISBN 9780415890601. Retrieved January 6, 2013.

- ^ Hansen, Harry, ed. (1966). The World Almanac and Book of Facts: 1966. New York World-Telegram. p. 68. OCLC 277006640.

- ^ a b c d e f g h i j k l m n o p q r Williams, Frank B. Jr. (November 1952). "The Poll Tax as a Suffrage Requirement in the South, 1870-1901". The Journal of Southern History. 18 (4). Athens, Georgia: Southern Historical Association: 469–496. doi:10.2307/2955220. ISSN 0022-4642. JSTOR 2955220. Retrieved October 28, 2020.

- ^ "Federal Judges Strike State's Poll Tax". The Anniston Star. Anniston, Alabama. Associated Press. April 8, 1966. p. 1. Retrieved November 8, 2020 – via Newspapers.com.

- ^ Branam, Chris M. (Autumn 2010). "Another Look at Disfranchisement in Arkansas, 1888—1894". The Arkansas Historical Quarterly. 69 (3). Fayetteville, Arkansas: Arkansas Historical Association: 245–262. ISSN 0004-1823. JSTOR 23046114. Retrieved December 15, 2020.

- ^ Lackey, John (1965). "The Poll Tax: Its Impact on Racial Suffrage". Kentucky Law Journal. 54 (2). Lexington, Kentucky: University of Kentucky College of Law: 423–432. ISSN 0023-026X. Archived from the original on March 21, 2020. Retrieved October 31, 2020.

- ^ Room, Anne T. Kent California (June 18, 2021). "History of the California Poll Tax". Anne T. Kent California Room Newsletter. Retrieved July 29, 2022.

- ^ "Poll Tax Receipts". Jacksonville Public Library. Retrieved January 24, 2020.

- ^ "Dade Men Hail Teachers' Aid, Poll Tax Death". Daily News Bureau. Miami Daily News. June 6, 1937. Retrieved January 24, 2020.

- ^ a b Ogden, Frederic D. (1958). The Poll Tax in the South. Birmingham, Alabama: University of Alabama Press. p. 4. OCLC 918357443.

- ^ Gigantino, Jim (August 20, 2020). "Constitutional Convention of 1877". georgiaencyclopedia.org. Atlanta, Georgia: Georgia Humanities. Archived from the original on November 12, 2020. Retrieved December 15, 2020.

- ^ "State Constitution of Louisiana, 1898, Suffrage and Elections". The Gilder Lehrman Center for the Study of Slavery, Resistance, and Abolition. April 8, 2015. Retrieved July 29, 2022.

- ^ Podolefsky, Ronnie L. (1998). "Illusion of Suffrage: Female Voting Rights and the Women's Poll Tax Repeal Movement after the Nineteenth Amendment". Notre Dame Law Review. 73 (3). Notre Dame, Indiana: University of Notre Dame. ISSN 0745-3515. Archived from the original on October 3, 2020. Retrieved October 28, 2020.

- ^ "Maine Senate Votes Repeal of Poll Tax on Adult Males". New York Times (March 13): 35. 1973.

- ^ "Poll Tax Receipts". My Times with the Sisters. Retrieved March 10, 2020.

- ^ "Rule State Poll Tax Is Unconstitutional". The Hattiesburg American. Hattiesburg, Mississippi. Associated Press. April 8, 1966. p. 1. Retrieved November 5, 2020 – via Newspapers.com.

- ^ "Oklahoma Repeal Poll Tax, State Question 590 (1986)". Ballotpedia.

- ^ Bemesderfer, Jean (Fall 2020). "Speaking of Rights and Wrongs: Fighting for Black Women's Suffrage, Part Two" (PDF). Northampton County Historical and Genealogical Society Newsletter. Easton, Pennsylvania: Northampton County Historical and Genealogical Society. Archived (PDF) from the original on November 11, 2020. Retrieved November 11, 2020.

- ^ "Poll Tax Dropped as S. C. Voting Requirement". The Index-Journal. Greenwood, South Carolina. Associated Press. February 13, 1951. p. 1. Retrieved December 13, 2020 – via Newspapers.com.

- ^ Lester, Connie L. (2002). "Disfranchising Laws". Tennessee Encyclopedia. Nashville, Tennessee: Tennessee Historical Society. Archived from the original on November 25, 2020. Retrieved December 15, 2020.

- ^ a b Alexander, Seth; Blentlinger, Kaitlyn; Hagemann, Amber; Bean, Nathan (April 29, 2015). "1963, 1966: Campaigns to Repeal Texas Poll Taxes". South Texas Rabble Rousers History Project. Corpus Christi, Texas. Archived from the original on June 6, 2016. Retrieved October 31, 2020.

- ^ Congress, United States (1965). Congressional Record: Proceedings and Debates of the ... Congress. U.S. Government Printing Office.

- ^ "High Court Kills Virginia's Poll Tax in 6-to-3 Decision (pt. 1)". The Danville Register. Danville, Virginia. Associated Press. March 25, 1966. p. 1. Retrieved November 8, 2020 – via Newspapers.com.

- ^ "Court (pt. 2)". The Danville Register. Danville, Virginia. Associated Press. March 25, 1966. p. 2. Retrieved November 8, 2020 – via Newspapers.com.

Further reading

- Highton, Benjamin (2004). "Voter Registration and Turnout in the United States". Perspectives on Politics. 2 (3): 507–515. doi:10.1017/S1537592704040307. JSTOR 3688813. S2CID 145629037.

- Besley, Timothy; Case, Anne (2003). "Political Institutions and Policy Choices: Evidence from the United States" (PDF). Journal of Economic Literature. 41 (1): 7–73. doi:10.1257/.41.1.7. JSTOR 3217387.

- Wechsler, Herbert (April 1954). "The Political Safeguards of Federalism: The Role of the States in the Composition and Selection of the National Government". Columbia Law Review. 54 (4): 543–560. doi:10.2307/1119547. JSTOR 1119547.