Last updated on September 14, 2021

European payments law, known as the Second Payment Services Directive, or PSD2, introduced major changes that significantly impacted multisided platforms, or marketplace businesses, in Europe. Many of these businesses cannot rely on an exemption from licensing that they availed of previously.

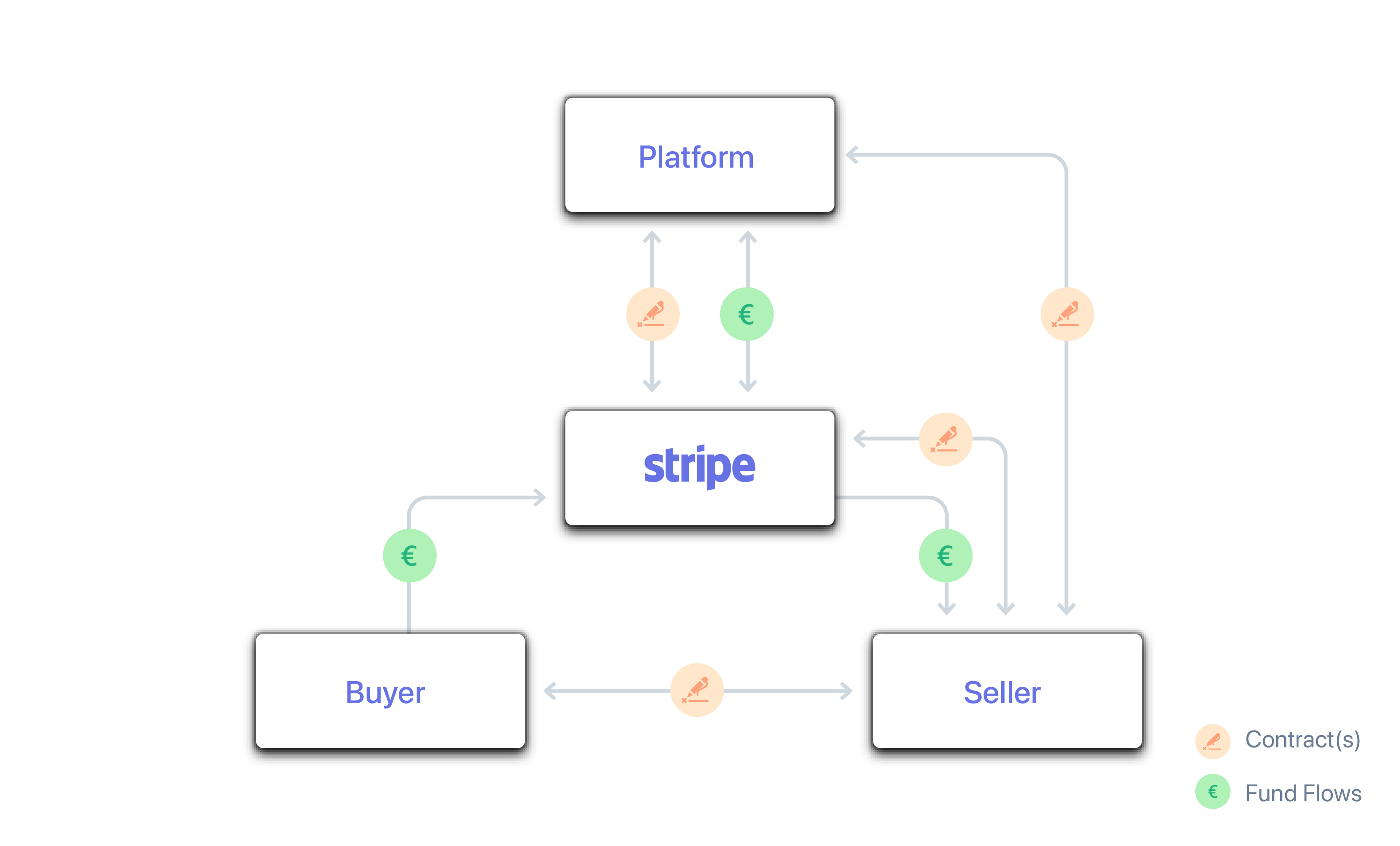

In a typical marketplace setup, where a platform acts as an intermediary for both buyers and sellers without itself selling the product or service, the platform cannot receive payments that are owed by buyers to sellers. If it does, it will have to obtain a payments license from a regulator and become a regulated business. Stripe Connect offers such platforms an alternative: Platforms that use Stripe Connect do not receive payments owed by buyers to sellers, and instead of having to become a licensed provider of regulated payment services, they can concentrate on growing their marketplace businesses. For more on the regulatory changes under PSD2, take a look at our guide below.

Multisided platforms, or marketplace businesses, are among the most exciting internet businesses, transforming how we buy and sell today. From on-demand services to business-to-business (B2B) platforms, crowdfunding to the sharing economy, and ecommerce to booking platforms, marketplace businesses are unlocking access to global customer bases, broadening consumer choice, and enabling sellers to scale their businesses far beyond what was possible before. Stripe supports many of these platforms on Stripe Connect, a uniquely compliant product for platform payments.

Online platforms function as central portals that enable transactions between buyers and sellers. From early pioneering platforms, such as eBay and Amazon, to more recent successes, such as Shopify, Etsy, and Kickstarter, a hugely diverse platform industry has developed globally, providing both customers and suppliers with new markets and choices. Europe has been the birthplace of many innovative platforms, such as Deliveroo, Catawiki, and ManoMano, as well as new fintech platforms, such as Zopa and Monzo.

As platforms become increasingly important drivers of digital commerce in Europe, their role has attracted heightened regulatory scrutiny, seeking to ensure that customer protection, anti-money laundering, and competition rules keep pace with technological innovation. From our experience powering payments for thousands of platforms around the globe, we’ve encountered many of the regulatory challenges that platforms face.

In this guide, we share some perspectives on how platforms in Europe can best navigate the regulatory changes in PSD2, which significantly impact how platforms manage payments. Many platforms receiving payments in Europe have relied on the so-called “commercial agent” exemption from payments licensing. We explore how this exemption has changed and the impact this has on the regulatory position of platforms in Europe. Although this is not legal advice (platforms should independently assess their own unique setups), our views are based on our experience of the complex payments regulatory landscape on which our platform payments product, Stripe Connect, is built.

The key change for platforms is that if they act on behalf of both buyers and sellers, like most platforms do, then platforms can only avoid becoming a licensed and regulated business if they do not possess or control funds and, instead, rely on a licensed payment service provider. Stripe Connect addresses these regulatory concerns for platforms, abstracting away the complexities of payments licensing and making regulatory compliance less burdensome for platforms.

How do platforms operate?

Contractual setup

Most online platforms are set up so that the platform merely facilitates the sale from the seller to the customer (buyer) but does not act as a seller or reseller. The seller makes the sale to the buyer and the buyer owes a payment to the seller. The platform generally passes economic risk to the seller, which also takes on certain financial, legal, and tax obligations associated with the sale of products or services to the buyer. Examples of obligations that may fall on the seller, rather than the platform, include liability for: products delivered to a consumer; returns; local VAT requirements; and licensing or mandatory insurance requirements for products or services that are licensed or insurable (e.g., mandatory third party insurance for taxis).

This typical marketplace construct of facilitating but not making sales is often essential to the economic success of platforms, many of which could not exist otherwise. Platforms try to ensure their role is merely to facilitate the sale of products or services by including language in their contracts with sellers, such as: “The contract for the supply of the service will be between you and the customer” or “The platform only plays a facilitation or supporting role” or “The responsibility of the platform is limited to facilitating the availability of the site, application, and services.” Platforms often do not contract with the buyer and instead, the seller contracts with both the buyer and the platform.

Payments setup

Even though the buyer owes a payment to the seller, many platforms manage payments themselves and act as intermediaries between buyers and sellers. When the buyer makes a payment for the product or service, the payment is often received by the platform and subsequently paid out to the seller by the platform.

This flow of payments owed by the buyer to the seller is often not aligned with contractual liability, as illustrated below. Even though the platform does not make the sale to the buyer and is not owed a payment from the buyer, the platform often receives the payment from the buyer that is owed to the seller. However, the buyer’s debt to the seller is not settled or extinguished when the platform receives the funds.

Where the platform receives payments from the buyer for sales made by the seller, i.e., handles money that is beneficially owned by the seller, most interpretations of European payments law consider this to be regulated activity. This requires the platform to obtain a payments license, unless it falls within an exemption. Many platforms that manage payments in this way relied on the “commercial agent” exemption under PSD1 (the predecessor to PSD2) as their basis for not being licensed; however, this exemption changed under PSD2. Before exploring the commercial agent exemption, it is useful to understand what payment services are regulated.

What are regulated payment services?

The following activities are considered regulated payment services in the EU:

- Operating a payment account and enabling cash to be placed on and withdrawn from a payment account—e.g., holding funds for a business in a bank account before settling them pursuant to the business’s instructions

- Executing payment transactions—e.g., processing payments from customers to businesses

- Issuing payment instruments or acquiring payment transactions—e.g., acquiring and processing credit card transactions

- Money remittance—e.g., transferring funds on behalf of a payer to a payee

- Payment initiation services—new under PSD2, e.g., initiating a payment, such as a bank transfer, from a customer’s bank account to a business

- Account information services—new under PSD2, e.g., providing consolidated or aggregated information regarding payment accounts held with payment service providers

With Stripe Connect, we provide regulated payment services to platforms in Europe, pursuant to our authorization as an Electronic Money Institution.

Where a platform enters into possession or control of funds owed by a buyer to a seller and later settles them to the seller, the platform would be considered to be providing regulated payment services (such as operating a payment account, executing payment transactions, or money remittance), unless it falls within an exemption, such as the commercial agent exemption.

What is the commercial agent exemption?

Platforms have invoked the commercial agent exemption by asserting that they are acting as a commercial agent that is authorized to negotiate or conclude the sale of products or services on behalf of the seller. Under this construct, the buyer is considered not to be paying the platform but, instead, to be paying the seller, via its commercial agent (the platform). The seller is treated as receiving payment, in legal terms, as soon as the payment is received by its agent, the platform. Many platforms have tried to rely on this exemption in lieu of becoming a licensed provider of regulated payment services.

Many regulators in Europe hold the view that platforms, in aggregating market supply with market demand (bringing buyers and sellers together in a website or app), are acting for both the payer (receiving orders and payments from the buyer, as well as potentially offering the buyer benefits, such as member discounts) and the payee (sending orders and payments received to the seller). Pre-PSD2, some countries permitted a commercial agent to act on behalf of both the payer and payee, but other countries applied the exemption more strictly, and only permitted the commercial agent to act on behalf of either the payer or the payee, but not both. In addition, some regulators held the view that since there is no actual negotiation or conclusion of the sale by the platform, the platform should not be considered a commercial agent. This inconsistent application of the commercial agent exemption was problematic for platforms as, unlike a payments license, an exemption in one country cannot be passported across Europe.

The commercial agent exemption under PSD2

PSD2 clarifies the gray area regarding commercial agents. The commercial agent exemption is now only available when a commercial agent very clearly acts on behalf of either the payer or the payee but not both. If acting for both, a platform is only able to avoid a licensing requirement if it does not possess or control funds (i.e., relies on a licensed payment service provider to do this). A widely held view by regulators throughout Europe is that platforms managing their own payments can no longer rely on the commercial agent exemption from licensing. PSD2 restates the commercial agent exemption as including “payment transactions from the payer to the payee through a commercial agent authorized via an agreement to negotiate or conclude the sale or purchase of goods or services on behalf of only the payer or only the payee.”

The change is explained in the preamble to PSD2, which states that the commercial agent exemption under PSD1 was:

…applied very differently across the Member States. Certain Member States allow the use of the exclusion by ecommerce platforms that act as an intermediary on behalf of both individual buyers and sellers without a real margin to negotiate or conclude the sale or purchase of goods or services. Such application of the exclusion goes beyond the intended scope set out in that Directive and has the potential to increase risks for consumers, as those providers remain outside the protection of the legal framework. Differing application practices also distort competition in the payment market. To address those concerns, the exclusion should therefore apply when agents act only on behalf of the payer or only on behalf of the payee, regardless of whether or not they are in possession of client funds. Where agents act on behalf of both the payer and the payee (such as certain ecommerce platforms), they should be excluded only if they do not at any time enter into possession or control of client funds.

To illustrate the change to the commercial agent exemption, the Financial Conduct Authority (FCA) in the UK states:

An example of where a platform will be acting for both the payer and the payee would be where the platform allows a payer to transfer funds into an account that it controls or manages, but this does not constitute settlement of the payer’s debt to the payee, and then the platform transfers corresponding amounts to the payee, pursuant to an agreement with the payee.

The FCA also offers the specific example of an online fundraising platform, which accepts donations before transmitting them to the intended recipient. It says such a platform will not be able to rely on the commercial agent exemption because it is “not a commercial agent authorized via an agreement to negotiate or conclude the sale or purchase of goods or services on behalf of either the payer or the payee but not both the payer and the payee.”

The narrowing of the commercial agent exemption aims to protect payments made by consumers to sellers and avoid distortions of competition. Where a platform receives payments owed by the buyer to the seller, the seller is not only taking on the contractual obligation to the buyer, but also the additional credit risk of the platform defaulting before it pays the seller. From a competition perspective, PSD2 attempts to level the playing field across Europe with regard to how individual countries apply the commercial agent exemption.

Other PSD2 considerations for platforms

The regular occupation or business activity test

Platforms should also consider whether their payment services are a “regular occupation or business activity” as, according to PSD2, licensing is “confined to service providers who provide payment services as a regular occupation or business activity.” The FCA’s view on this is informative, stating that “the services must be provided as a regular occupation or business activity in their own right and not merely as ancillary to another business activity” and “the fact that a service is provided as part of a package with other services does not, however, necessarily make it ancillary to those services—the question is whether that service is, on the facts, itself carried on as a regular occupation or business activity.” It’s very difficult to imagine that a platform receiving payments from buyers and paying sellers for all transactions conducted through the platform would be considered merely ancillary and not a regular occupation or business activity of such a platform.

The limited network exemption

This exemption applies to a very limited range of activities, such as “closed loop” payments. However, even if platforms fall within the extremely narrow scope of the limited network exemption, they have to notify the relevant regulator if their payment transactions over the preceding 12 months exceed €1 million, upon which the regulator may require them to obtain a payments license.

How does Stripe approach payments for platforms?

When we designed Stripe Connect, we wanted the payments regulatory burden in Europe to fall on Stripe and our e-money license, rather than on platforms. To do this, we created an entirely new product, designing payment flows to ensure that platforms do not come into possession or control of funds.

For reasons discussed above, commercial realities mean most platforms want to facilitate sales rather than make sales, and, as they are acting on behalf of both buyers and sellers, it is critical that these platforms do not come into possession or control of funds. This is the central regulatory pillar behind Stripe’s development of Connect, and one of the primary reasons many platforms in Europe have chosen Stripe.

With Connect, Stripe contracts with both the seller and the platform to settle payments to the seller and fees to the platform. Funds that are owed by the buyer to the seller are never in the possession or control of the platform. Instead, these funds are settled to Stripe’s regulated client money bank account for the benefit of the seller, before being paid out to the seller by Stripe. The regulated payment services are rendered by Stripe instead of the platform, so the platform does not incur the significant regulatory and compliance overhead of getting a payments license or exemption. Returning to our combined liability and funds flow diagram, Connect operates like this:

In addition to taking on the payments regulatory burden, Connect’s product design also provides other benefits and safeguards for platforms, including:

- Helping you onboard and verify sellers. Stripe leverages its experience from verifying millions of accounts and uses proprietary systems to approve more users with less friction.

- Customizing the seller’s experience, e.g., sellers can agree to let the platform manage the seller’s experience, including the UI, reporting, payouts management, and communicating with the Stripe API.

- Innovative payment functionality within Connect that supports many business models, e.g., One-to-Many, Many-to-Many, Holding Funds, Account Debits, Instant Payouts, and more.

- Local transaction routing, resulting in better acceptance rates and lower-cost payments from customers in 135+ currencies and payment types, including SEPA Direct Debit, Sofort, Alipay, WeChat Pay, and more.

- Local payouts to sellers in local currencies, allowing platforms to internationalize their businesses without local entities or bank partners (enabling payouts in 15+ currencies in 30+ countries around the world).

- Protection of sensitive card information to a PCI Level 1 standard so platforms don’t have to worry about being PCI compliant.

- Advanced modeling and machine learning, which powers Stripe Radar, to monitor transactions from end to end, detect and prevent fraud, and take action where we find suspicious activity.

In summary, Connect provides platforms in Europe with a sophisticated and compliant payments flow that enables platforms to design their agreements with their sellers in compliance with local payments law, without having to pursue their own payments licenses and become regulated businesses. Stripe shoulders this regulatory burden so that platforms can focus their time and resources on running their businesses. Many hundreds of platforms with sellers across Europe have already chosen to rely on Stripe Connect, rather than having to obtain their own payments license or fit within a narrow exemption.

This guide is provided for informational purposes, and platforms should always independently verify their own unique regulatory positions. If you have questions regarding Stripe Connect, we’d love to hear from you.

For responses to commonly asked user questions regarding the regulatory status of Stripe Connect in Europe, please see this FAQ page.