- SUPERVISION NEWSLETTER

Charting the future: risks and lending standards in residential real estate

15 May 2024

Residential real estate (RRE) risk is one of the ECB’s key areas of supervisory focus under the supervisory priorities for 2023-25. Historically, RRE has often played a major role in global economic health. More than two-thirds of the almost 50 systemic banking crises in recent decades have been preceded by boom-bust trends in house prices, according to the International Monetary Fund’s 2019 Global Financial Stability Report. The literature on housing and equity market bubbles also shows that when a housing market bubble bursts, especially if it had been fuelled by credit, this can be followed by a deep recession and a financial crisis. Euro area RRE markets saw continued expansion throughout the decade following the global financial crisis, when vulnerabilities related to house price overvaluation, household indebtedness and risky lending standards accumulated. According to the most recent ECB’s Financial Stability Review, the current environment of tighter financing conditions is reducing the affordability of and demand for real estate assets, putting downward pressure on prices. In addition, debt service costs have increased for existing borrowers, making it more difficult for them to meet mortgage repayments.

Chart 1

Trend for house prices and inflation rate (HICP) in the euro area

(percentages)

Sources: ECB and Eurostat. House price index (2015 = 100) – quarterly data for euro area (20 countries).

Note: HICP stands for “Harmonised Index of Consumer Prices”.

Amidst all these challenges, it is important to note that the outlook is not entirely bleak. While there are concerns about potential risks materialising, recent data point to some degree of stabilisation in house price drops and resilience in the labour market, which could mitigate default risks on mortgages. However, should these risks materialise they would have a direct impact on banks’ credit losses. This impact would be significant, especially as total loans to households secured by RRE account for 26% of banks’ total loans and advances (€3.8 trillion out of €14.7 trillion). It is therefore crucial that banks closely monitor these risks.

Chart 2

Composition of significant institutions’ loans and advances as at 31 December 2023

Source: ITS data (FINREP).

Notes: “CRE” stands for commercial real estate under the CRR definition (commercial immovable property); “NFC” stands for non-financial corporations; “L&A” stands for loans and advances.

Against this background, the approaches adopted by banks to the origination and monitoring of RRE loans have remained an important ongoing focus of supervisors. Over the last few years, ECB Banking Supervision has carried out onsite work as well as a series of offsite targeted reviews. To date, the focus of RRE onsite inspections has been on risk classification and expected credit losses modelling practices. Meanwhile, the offsite reviews performed in late 2022 and in 2023 focused on assessing whether banks are following the EBA Guidelines on loan origination and monitoring (LOaM), complementing the valuable insight gained from onsite activities. Supervisors assessed banks’ credit underwriting and risk management practices to reach an understanding of how well prepared banks are to face the challenges that would arise if certain risks were to materialise. Specifically, banks’ practices were examined in the following five areas: banks’ portfolios and strategies to deal with RRE risks, the loan origination process, loan pricing, collateral valuation and the integration of climate change risk into RRE risk.

The targeted RRE review examined 37 banks with material and growing RRE portfolios. Their combined RRE portfolio of €1.4 trillion represented around 40% of the aggregate RRE exposures (amounting to around €3.7 trillion) of all banks under the ECB’s direct supervision and saw notable growth of 13% from June 2021 to June 2023.

Chart 3

Evolution of loans for house purchase for a sample of 37 significant institutions

(index: Q2 2021 = 100)

Source: ECB ad hoc data collection for sample banks. The chart shows the evolution from Q2 2021 to Q2 2023 for domestic portfolios of loans for house purchase for the sample banks. The evolution includes both stock and the contribution from newly originated loans over the period.

RRE portfolios differ across Europe, as do banks’ practices

The review revealed that banks’ RRE business and risk management practices differ across European countries and clearly lack homogeneity. The review also highlighted the fact that mortgages across the banks in scope are not always plain vanilla and span a wide range of products, some of which bear more risk than a basic mortgage product. Such products include, for example, loans insured but not backed by real estate collateral, loans with no mortgage inscription but a mandate for this in the event of credit deterioration, partially amortising loans with interest rate fixation periods that are shorter than the loan’s lifespan, interest-only mortgages (bullet capital repayment) and mortgages with maturity extending beyond life expectancy. There is also heterogeneity across banks and countries in terms of the structure of their interest rate product offering. For instance, while banks in some countries operate mainly on the basis of mortgage loans with variable interest rates, others originate only fixed-interest loans. According to data from June 2023 for the sample of banks in the review, the interest rate fixation period will have expired for loans totalling €412 billion by June 2025. This will entail a material risk for borrowers not able to meet higher interest rates.

Findings on loan origination processes

With regard to loan origination practices, the review revealed that (generally speaking) there was no harmonised usage of loan origination indicators. Mortgage-granting criteria such as the loan-to-value (LTV) ratio, the debt-service to income (DSTI) ratio or maturity were not based on borrowers’ risk and were associated with high origination thresholds. The risk posed by the value of the property in relation to the loan amount, as well as the risk arising from the borrower’s primary source of repayments, are often not fully considered. For sample banks operating in certain countries, credit-granting policies often lack important thresholds such as LTV or DSTI ratios. In addition, at origination banks commonly apply soft limits which can always be exceeded using the escalation procedure, leaving room for riskier lending. Among the banks in the sample, in the 12-month period between June 2022 and June 2023, 46.5% of mortgage loans were originated with an LTV ratio of above 80% (16.5% above 100%). Between June 2021 and June 2023, the share of loans originated to borrowers with a DSTI ratio of above 30% increased from 47% to nearly 53%. The 30% threshold is not risky in itself but it is from that level onwards that deterioration might appear: borrowers with higher DSTI have less disposable income than those with lower DSTI ratios and, therefore, smaller buffers to absorb additional costs.

Banks also seem to struggle with the implementation of repayment capacity sensitivity analysis as a part of individual borrowers’ creditworthiness assessments. According to the EBA Guidelines on LOaM, banks should carry out sensitivity analyses reflecting potential negative events in the future that might affect a borrower’s cashflow and, therefore, their ability to repay a mortgage. This additional “check” and its underlying assumptions help a bank to consider whether idiosyncratic and economic factors, such as a reduction in income due to personal circumstances, increased interest repayments or negative scenario on future expected inflation will be financially manageable for the borrower. Additionally, for some banks in the sample the review showed that there was no uniform measure of disposable income and no control over cost-of-living assumptions, resulting in a potential underestimation of risks. Most – but not all – banks have linked their cost-of-living assumptions to inflation in order to reflect rising costs.

Cracks in the foundations of collateral valuation practices

The value of the property pledged as collateral provides banks with protection. This allows them to recover the outstanding amount of a loan if a customer is not able to meet repayment obligations and it becomes necessary to sell the collateral. To mitigate any risk associated with the value of the property, it is crucial for banks to have sound and prudent collateral valuation practices in place. The EBA Guidelines on LOaM stipulate that collateral should be valued at origination by an independent valuer, either fully onsite or via a desktop valuation if the property market is mature and well developed. The valuer may be internal to the bank or from an external company, as long as the criteria of independence and expertise are met, as set out in the EBA Guidelines on LOaM. Many banks in the sample were not fully compliant with the Guidelines and may therefore have underestimated the risks associated with the assets financed. The targeted review data revealed that for around 40% of new RRE loans originated between Q2 2021 and Q2 2022, collateral valuations were not carried out by a valuer. In such cases banks either relied purely on purchase price or depended excessively on statistical tools without involving an independent valuer at origination.

According to the BCBS’s review of the differentiated nature and scope of financial regulation, the need for prudent collateral valuation practices was one of the key lessons learnt from the global financial crisis. Independent valuers should play a crucial role in the valuation. ECB Banking Supervision expects banks to have valuers carry out a proper review rather than just a “tick-box” confirmation of the outcome of the valuation model. The advanced statistical tool should only be used as a supporting tool.

In the ECB’s view it is unacceptable not to involve valuers in the process unless, for a specific loan and a specific collateral, the risk is low and evidenced, for example, by low LTV indicators. First, it is essential to involve valuers to comply with the requirements of the Capital Requirements Regulation (CRR) concerning eligibility of collateral, as explained in the EBA Guidelines. Second, valuers’ input helps ensure a level playing field in Europe and protects against potential overvaluation, which would negatively impact banks’ balance sheets if they had to recover the collateral for distressed loans.

Experienced valuers contribute towards reducing model risk via their individual assessments of a property’s value. They also assess the quality and status of a property, providing valuable insights that statistical estimates (if used alone) might overlook. Lastly, valuers help mitigate procyclicality by avoiding sole reliance on transaction prices or statistical estimates. The valuation of immovable property collateral must be carried out by a sufficiently experienced qualified appraiser who is independent of the credit decision process. Banks should ensure that these criteria are always met.

The perils of turning a blind eye to energy performance

The value of real estate is also linked to its energy performance and, over time, it is expected that consumers will tend to choose greener houses. Valuation reports which include relevant energy performance information such as the location, energy consumption and date of renovation could be crucial sources of initial climate-related data. The absence of valuation reports including such key information could make it more costly and complex for banks to acquire it. Over time, the value of real estate will be increasingly linked to both transition and physical risks as society evolves and consumers choose homes which are more energy efficient, use less energy and are located in areas less exposed to hazard events such as floods. To manage credit risk and measure it accurately, banks will need to collect basic information on the energy performance and location of the collateral they are holding on their balance sheets.

The thematic reviews revealed that banks do not have a large share of energy performance certificate (EPC) data, either for new loans or for existing stock. While progress has been made in requiring EPC data at origination, many banks still lack a strategy for collecting EPC data for existing loan stock. It is crucial for banks to continue with their efforts to gather more energy performance data (including the address) at origination and, simultaneously, develop strategies for collecting more information on energy performance for loan stock.

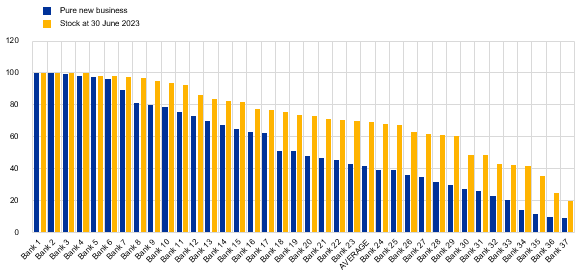

Chart 4

Share of unknown EPC data on loan stock (as at 30 June 2023) and new loans (originated between 30 June 2022 and 30 June 2023)

(percentages)

Source: ECB ad hoc data collection for sample banks.

Climate data: a catalyst for improved risk measurement

RRE markets face clear vulnerabilities as credit underwriting practices and lending standards evolve rapidly. Available supervisory data on households and banks’ real estate portfolios are limited in terms of comparability and completeness. First, there are comparability issues arising from the diversity of data sources and the absence of a harmonised definition of basic key risk indicators (KRIs). Furthermore, there is a notable lack of data on “pure” new business (all contracts, excluding renegotiated loans, that specify the interest rate of the loan for the first time) in supervisory reporting, along with missing useful KRIs. As part of the supervisory agenda, the ECB will contribute actively to the broader discussion on how to improve supervisory data and will advocate in favour of establishing a clear perimeter and scope as well as developing a harmonised set of KRIs relevant to RRE portfolios.

Conclusion

All banks that were part of the thematic review on RRE have received detailed benchmarking and communication in writing on the deficiencies identified. These banks have been asked to remediate deficiencies – follow-up actions are ongoing as a part of normal supervisory engagement. While the review uncovered some challenges in the RRE sector, the overall outlook remains relatively positive. Although RRE is under some stress, this appears manageable, and banks are actively engaged in addressing concerns. It is important to note that while some issues were identified, they are not expected to have a significant impact on the Supervisory Review and Evaluation Process or on capital. In addition, improving risk management practices is an ongoing focus in the day-to-day supervision of banks, and indicates that a proactive approach is being used to address potential vulnerabilities. Overall, while there are areas for improvement, the banking sector's response suggests there is a commitment to mitigating risks and maintaining stability in the RRE landscape.

Supervisors and banks must consider the EBA Guidelines on LOaM and must ensure that sound and secure practices are adopted for RRE portfolios. This entails implementing new internal, risk-based loan origination thresholds to improve the robustness of credit-granting policies. It also means consistently involving qualified and independent appraisers with sufficient experience in the valuation of immovable property collateral. In addition, robust procedures must be implemented to request the actual EPC on RRE properties at origination as part of the mandatory information, and IT systems need to be developed or integrated to facilitate the retrieval and storage of key information from the EPC. These expectations will be closely aligned with supervisory follow-up and priorities in the coming years, with a particular focus on banks’ adherence to regulatory standards and the implementation of prudent risk management practices.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts