We would like to thank you for your continued support. We are pleased to report that our fiscal year 2023 ended on March 31, 2024. It would be most grateful if you, could provide continued support and cooperation.

Akinori Higuchi

Representative Director, President, and CEO

Sanyo Chemical Group business environment in FY2023

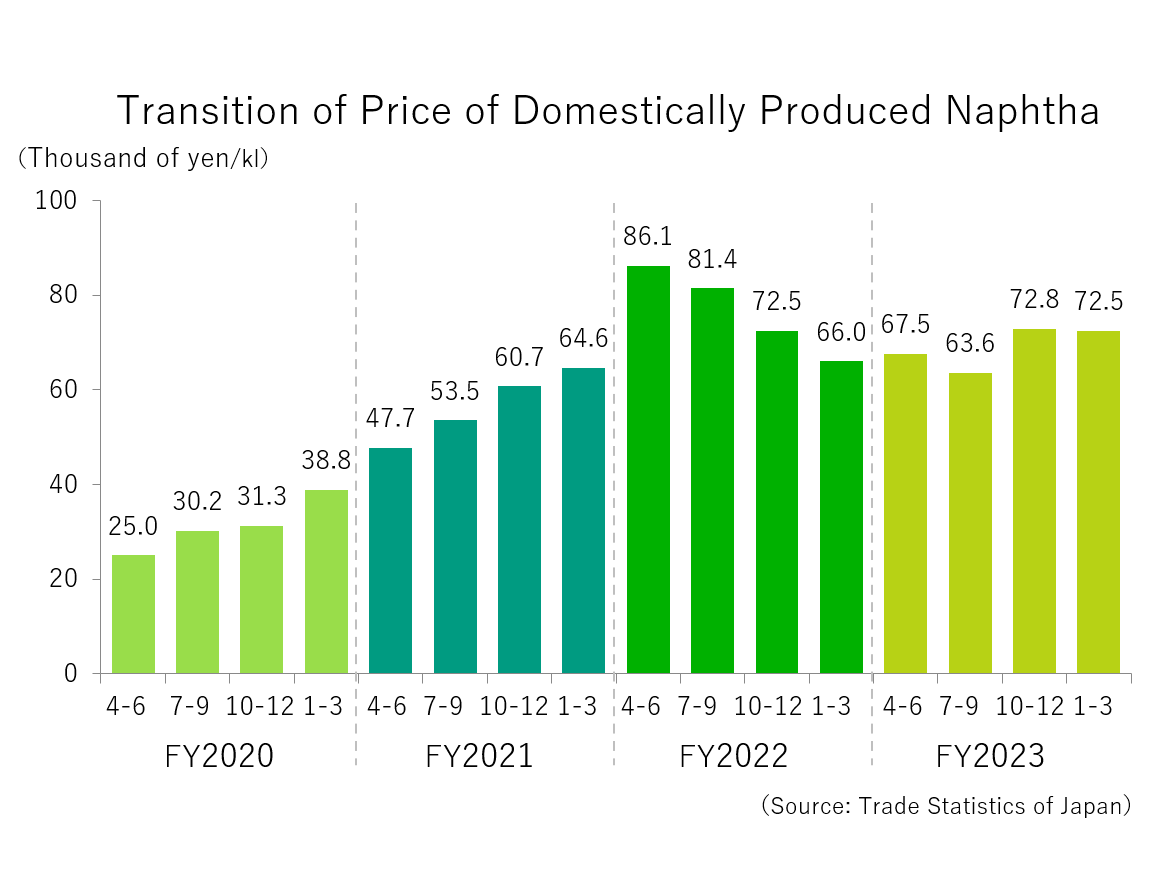

During the fiscal year ended March 31, 2024, the Japanese economy continued to normalize with the reclassification of COVID-19 as Category V Infectious Diseases under the Infectious Diseases Control Law, and saw a recovery in individual consumption and exports. However, conditions remained challenging due to factors such as a diminished capital investment appetite around the world. In the global economy, while the U.S. economy remained resilient, the European economy tended to slow down, and China’s economic recovery has lagged due to factors such as sluggish exports and deteriorating real estate market conditions. In addition, resource and energy prices remained high and inflationary due to the prolonged situation in Russia and Ukraine and deterioration of the situation in the Middle East, making the outlook uncertain.

In the chemical industry, the foreign exchange market saw a moment where the yen rallied due to factors including the slowdown in the U.S. inflation rate and heightened expectations for a normalization of monetary policy by the Bank of Japan. However, a trend of yen deprecation persisted throughout the year due to long-term fiscal tightening in the U.S. and Europe. Oil prices were trending upwards amidst growing tensions in the Middle East, despite the global economic slowdown. Additionally, sluggish domestic demand in China, coupled with an oversupply of Chinese products, intensified price competition in Japanese and other Asian markets, among others. Given these factors, the business environment remains unpredictable.

Results for FY 2023

Net sales for the fiscal year under review decreased by 8.8% year on year to ¥159,510 million, primarily due to a decrease in sales volume. In terms of profit, operating profit was ¥4,886 million (a decrease of 39.8% year on year), primarily due to factors including a decrease in sales volume and an increase in depreciation associated with the implementation of the new core system. Ordinary profit was ¥8,186 million (a decrease of 17.5% year on year), and loss attributable to owners of parent was ¥8,501 million (compared to profit attributable to owners of parent of ¥5,684 million during the previous fiscal year), primarily due to the recording of impairment losses at a consolidated subsidiary and losses resulting from the withdrawals from the superabsorbent polymer business, as well as the production business in China (Business restructuring expenses).

Withdrawal from Superabsorbent Polymers Business and China Production Business

As announced on March 25, we have decided to withdraw from the superabsorbent polymer ( “SAP”) business and the cease production of surfactants and other products in China (the “Business Withdrawal”)as part of the structural reforms under the “New Medium-Term Management Plan 2025” starting from fiscal 2023.

As a result of this Business Withdrawal, we expect to record extraordinary losses of approximately 20 billion yen (approximately 12 billion yen for the FY2024) over several fiscal years beginning in FY2023. These losses will cover restructuring costs, such as fixed assets and termination payments. In addition, as part of its business restructuring, including this Business Withdrawal, we expect an improvement in operating profit of around 1 billion yen in FY2024 compared to the previous period.

Since the world’s first commercial production of SAP in 1978, we have expanded our SAP business in line with the global spread of disposable diapers and have contributed to the expansion of the Asian diaper market and improvement of the quality of life (QOL) through the stable supply of high-quality SAP. However, the profitability of our SAP business has rapidly deteriorated due to the influx of new SAP manufacturers, intensifying competition in the SAP market and in recent years,. as the technology level of new entrants has improved, SAP has become commoditized, shifting the competitive landscape toward cost competitiveness rather than quality differentiation. Considering this challenging situation, we have been exploring various options for several years, including restructuring, collaboration, and the possible sale of the SAP business.

Despite incurring a significant extraordinary loss as detailed above, we firmly believe that the implementation of these structural reforms will ultimately enhance profitability and cash flow, and that by appropriately allocating management resources to growth businesses, we will be fostering accelerated growth over the medium to long term. We will continue to accelerate the transformation of our business portfolio by improving the profitability of our core businesses, developing new businesses by leveraging our existing businesses, and creating new growth paths to transform our business portfolio.

About the New Medium-Term Management Plan 2025

In order to clarify the path for sustainable growth toward the realization of our vision for 2030, we have formulated the “New Medium-Term Management Plan 2025” and the entire group is working together to enhance the value of the entire supply chain.

Due to changes in the business environment, our current business performance is in a difficult situation, and we have fallen short of our initial plan for fiscal year 2023, the first year of the medium term plan. Despite this environment, we have been steadily implementing initiatives to reach our “vision” and in FY2023 we were able to push forward with a series of structural reforms, including the withdrawal from the SAP business and other businesses as part of our “review of core businesses. As a result, we believe we have made a step forward in creating an environment to improve profitability.

During the remaining period of the medium term plan, we will strive to generate and accumulate profits by thoroughly implementing our “business strategy” aiming to achieve an operating income of 15 billion yen in FY2025. We will also strengthen our efforts for the future by accelerating our “transformation to realize our vision” and promoting new development projects to get on a “new growth paths”.

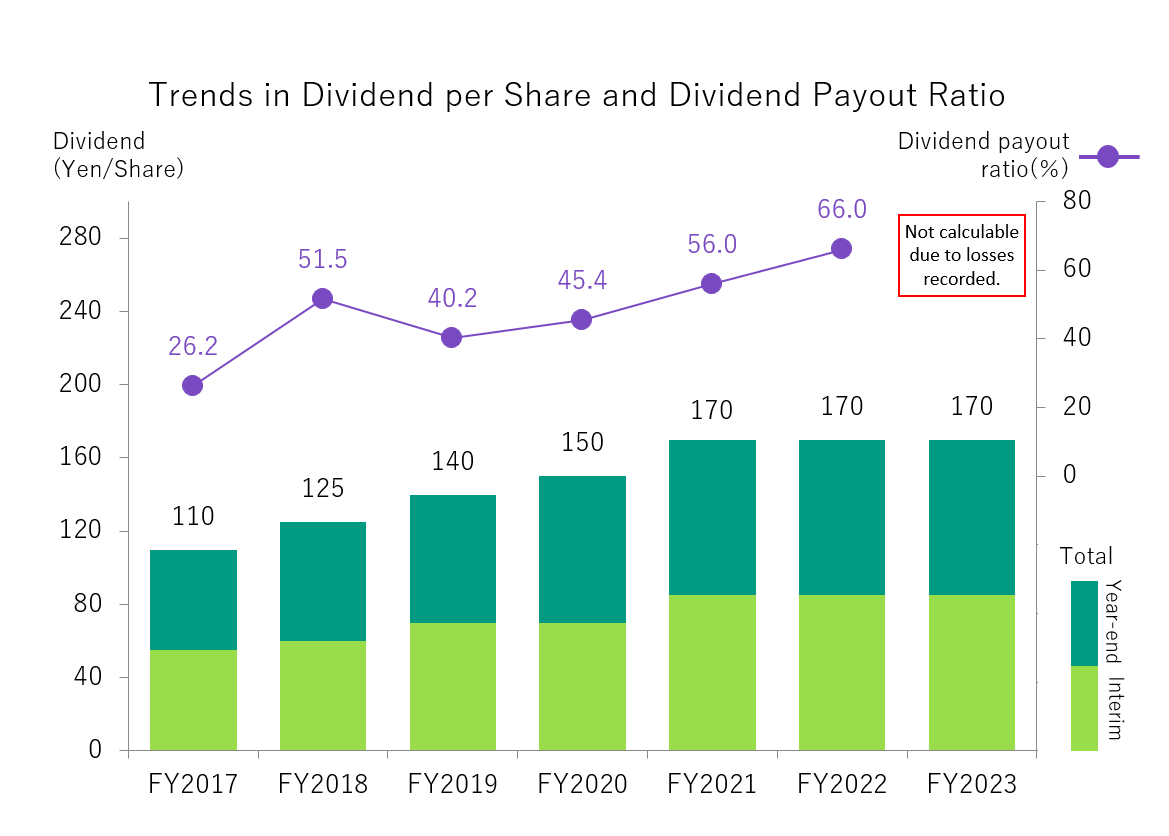

Return of profits

The year-end dividend for FY2023 was 85.0 yen per share (annual dividend of 170.0 yen per share). For the next fiscal year, we plan to pay an interim dividend of 85.0 yen per share and a year-end dividend of 85.0 yen per share (equating to an annual dividend of 170.0 yen per share). The Company considers it an important management issue to enhance the return of profits to shareholders while improving the earning capacity of the Group by reinforcing the corporate infrastructure into the future. We aim to increase the level of dividends over the medium to long term, with a target consolidated dividend payout ratio of 30% or more.

In conclusion, please give a message.

We are committed to improving our profitability, achieving sustainable growth in the future, and achieving our “vision” through these efforts, while at the same time providing enhanced returns to all of our stakeholders. We look forward to your continued support and cooperation.